With December 31 only a few weeks away, now is your last opportunity to make some smart moves to benefit your April tax bill. Keep in mind that your tax rate for 2019 and 2020 will essentially be the same (with modest adjustments for inflation) under the Tax Cuts and Jobs Act (TCJA). Here are a few things to consider:

#1 – Review Year-end Reports

It’s hard to make any financial decisions if you don’t know where you’re at. If you haven’t already met with us to discuss your year-end situation, take the time to run a few reports now. Walk through them before taking any steps. You’ll also be more prepared when it’s time to close out your books for 2019 and get your paperwork ready for tax filing. This includes reviewing names and addresses for both W-2 and 1099 workers.

#2 – Defer Income & Accelerate Deductions

The advice to defer income into the new year while accelerating deductible expenditures for 2019 still applies, especially if you expect to be in the same or lower tax bracket for 2020. (The opposite advice applies if you expect to be in a higher tax bracket next year.) So stock up on supplies and inventory, for example, and pre-pay expenses like insurance, rent and subscriptions.

#3 – Buy Depreciable Assets

The TCJA increased the Section 179 limit in 2018, which provides for first-year depreciation on qualifying equipment. For the 2019 tax year, small businesses can write off up to $1 million PLUS a 100% bonus on both new and used equipment. So, consider making additional acquisitions by December 31 if you can take advantage of this tax break. (We previously wrote about Section 179 expensing here.)

#4 – Write off Bad Debts

Take a look at your aging collections before year-end. Do you have a customer who you expect will never pay? You may be able to remove the customer’s balance from your total sales to reduce income. Be sure you want to write off the debt now because you’ll have to add it back later if the customer ends up finally paying.

#5 – Write off Obsolete Equipment & Inventory

Pull a list of all your current equipment and inventory. Are there items that are obsolete, damaged or unusable? You may be able to write off their full or partial value.

#6 – Pay Bonuses Now

Year end is a great time to reward your employees and contractors with a bonus, gift and/or holiday party. Many of these expenses can be treated as a deductible business expense. Be sure to run any bonuses through your payroll system for proper accounting.

#7 – Save for Retirement

If you haven’t already set up a retirement account for you and/or your employees, now is a great time. While you typically have until April 15 to actually fund the plan, some types of plans must be established before the end of the year in order to take advantage of the tax deduction. Not sure about your situation? Give us a call!

#8 – Make Note of Tax Changes

If you pay Georgia sales taxes, you should have received a letter from the Department of Revenue indicating your filing status for 2020. It may be the same or it may have changed frequency, so be sure to make any adjustments for the new year as needed. Note that there are NO changes to sales tax amounts in any Georgia county for January 2020.

Give Us a Call: 706-632-7850

We’ll be happy to answer any questions you might have regarding your year-end tax situation. We’re also booking appointments for tax filing beginning in January, so call us if you’re ready to get started!

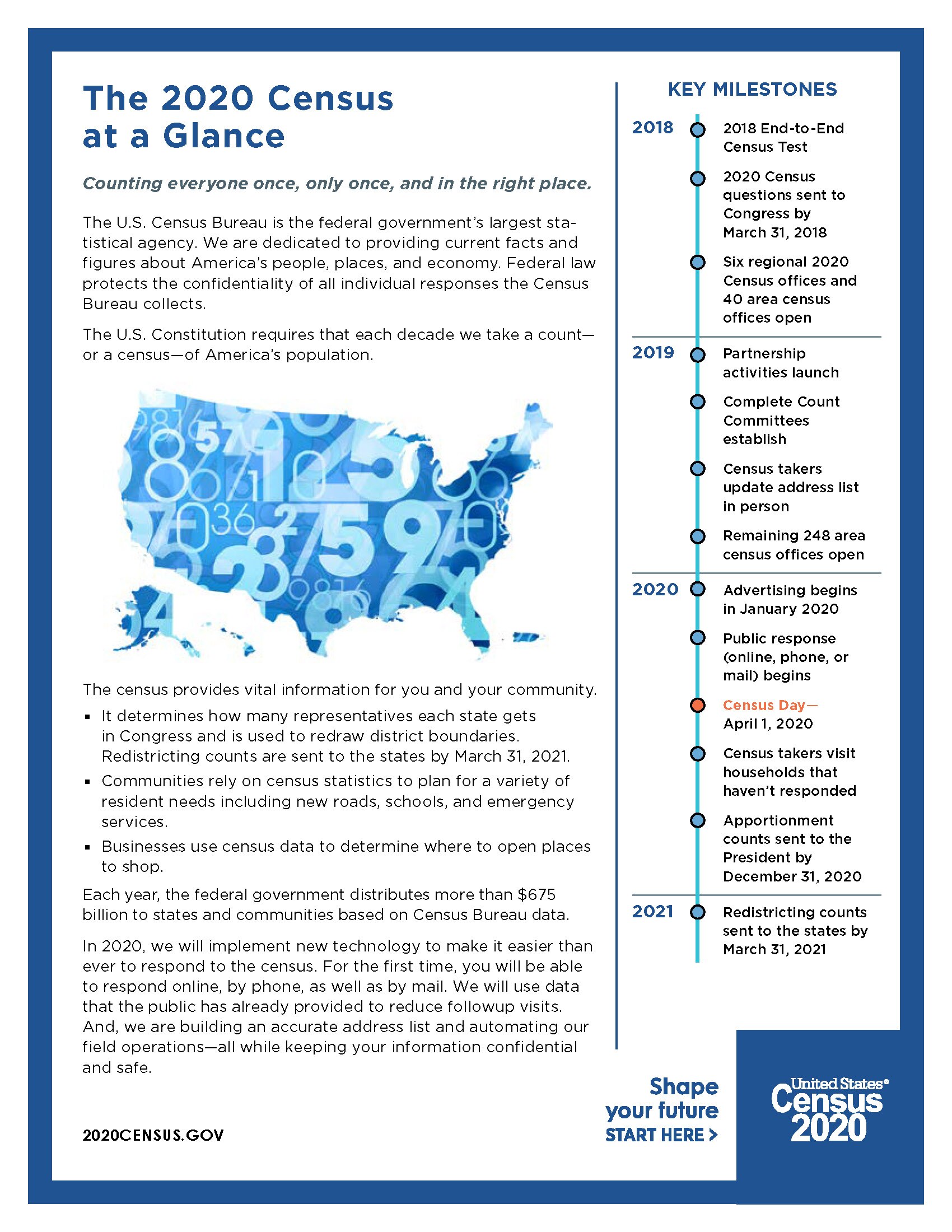

2020 Census Coming

The 2020 census aims to count the entire population of the U.S. at the location where each person usually lives. Census questions include how many people live or stay in each home, and the sex, age and race of each person.

Federal funds, grants and support to states, counties and communities are based on population totals and breakdowns by sex, age, race and other factors. So accurate census data is important for our community to get its fair share of the more than $675 billion per year in federal funds for schools, hospitals, roads, public works and other vital programs.

Businesses use census data to decide where to build factories, offices and stores, thus creating jobs. Developers use the census to build new homes and revitalize neighborhoods. Local governments use the census for public safety and emergency preparedness. Residents use the census to support community initiatives involving legislation, quality-of-life and consumer advocacy.

The original legal purpose of the decennial census is the apportionment of representatives among the states, which is mandated by the U.S. Constitution. Apportionment is the process of dividing the 435 seats in the U.S. House of Representatives among the 50 states based on the population counts that result from the census.

Click the image above for more census details.

Source: Census.gov