I think most of us will be glad when 2020 is finally over so we can look forward to a new start in 2021. As the year winds down in the next four weeks, take some time to look over your finances. There may be a few things you can do before the end of the year to get ready for the 2021 tax-filing season.

Check Your Financial To-Do List

#1 Report changes — If you moved in 2020, notify the IRS of your new address. Name changes should be updated with the Social Security Administration.

#2 Renew expiring ITINs — If your Individual Taxpayer Identification Number is set to expire at the end of this year, be sure to renew it now. Visit the ITIN page for more details.

#3 Donate to charity — Even if you don’t itemize your deductions anymore, the CARES Act passed earlier this year allows you to take a charitable deduction of up to $300 for cash contributions made to qualifying charities. The Coronavirus Aid, Relief, and Economic Security Act also temporarily suspends limits on charitable contributions and temporarily increases limits on contributions of food inventory.

#4 Check your EIP — If you received an Economic Impact Payment (EIP), you should have also received a Notice 1444, Your Economic Impact Payment, which you’ll need to give to your tax preparer. If you did NOT receive an EIP, you may be able to claim the Recovery Rebate Credit if you meet certain criteria. For additional information, visit the Economic Impact Payment Information Center.

If you received interest of at least $10 on a delayed federal tax refund for your 2019 return, you will receive a Form 1099-INT from the IRS. In true IRS fashion, this interest payment is taxable, and must be included on your federal tax return for 2020.

#5 Verify retirement plan distributions — The CARES Act waived required minimum distributions (RMDs) during 2020 for IRA or retirement plan accounts, and allowed eligible individuals to take a coronavirus-related distribution of up to $100,000 by December 30, 2020. Ask us for more details, or visit the IRS’s page on retirement plan relief.

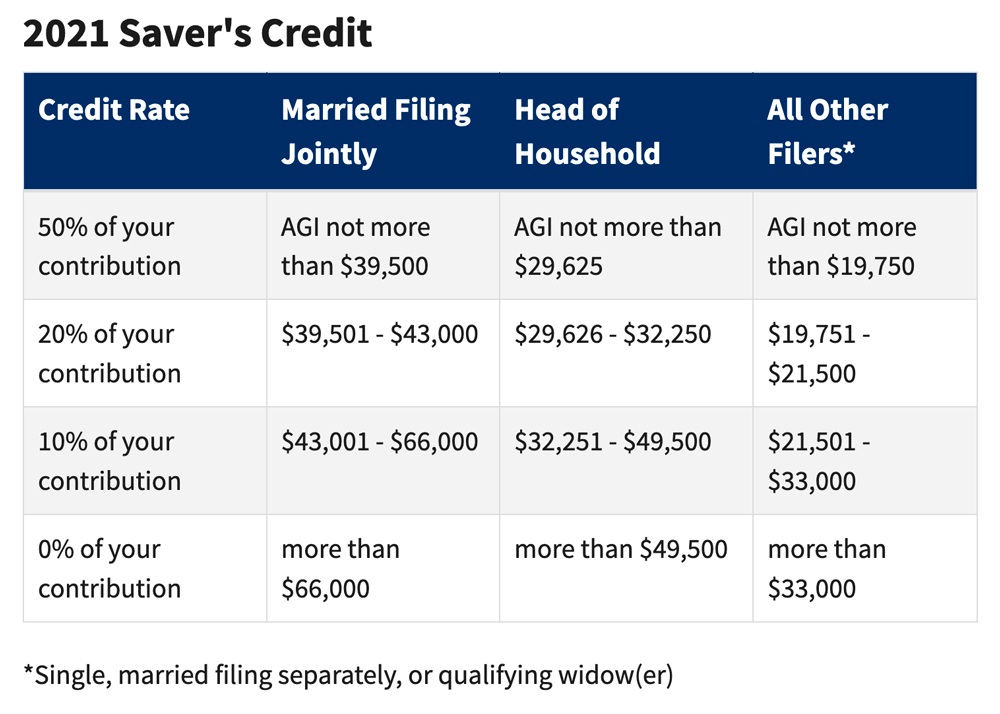

#6 Contribute to your retirement plan — Depending on your AGI, you may be able to take a tax credit of 50%, 20% or 10% of eligible contributions to your IRA or employer-sponsored retirement plan. While the total salary deferral limit for 2020 is $19,500 ($26,000 if you’re 50+), only contributions of up to $2,000 qualify for the credit ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). See the chart below for details.

Also note that the Setting Every Community Up for Retirement Enhancement (SECURE) Act repealed the maximum age for traditional IRA contributions, so you can continue to contribute to a traditional IRA at any age as long as you earn compensation. The SECURE Act also increased the minimum RMD age from 70½ to 72.

#7 Verify your withholding — Use the IRS’s tax withholding estimator to make sure your withholding and estimated taxes align with what you actually expect to pay. Keep in mind that most income is taxable, including unemployment compensation. If you received non-wage income like self-employment income, investment income, taxable Social Security benefits and, in some instances, pension and annuity income, you may be in danger of underpaying your taxes, which could result in penalties. In this case, you can make an end-of-the-quarter estimated tax payment or have additional taxes withheld from your next few paychecks.

#8 Make business purchases — If you own a business, consider purchasing some business supplies now to take the deduction in 2020. Everything from reams of paper to a new computer or desk can qualify as an eligible business expense.

Also note that the CARES Act fixed a technical issue with bonus depreciation, a provision that allows businesses to immediately deduct the full cost of many types of investments. The legislation expands bonus depreciation to qualified improvement property (QIP), which applies to almost any improvement to the interior of a building that is either owned or leased. The fix is retroactive, so businesses can deduct qualified improvements dating back to January 1, 2018, either by amending their 2018/2019 returns, or by employing an accounting method change.

Prepare Now for a Smooth Tax-Filing Season

With so many changes affecting tax filing for 2020, we expect there could be confusion and delays. Start gathering your paperwork now, so you’re ready to go when your Forms W-2, Forms 1099-Misc and other income documents start arriving in the mail. If you have any questions, we’re here to help — just call 706-632-7850 or email us.

Money Brief: Feb. 1, 2021, Deadlines

Wage and tax statements normally due on January 31 of each year will be due on Monday, February 1, 2021, because January 31 falls on a Sunday next year. Keep this in mind and plan ahead if you are required to file:

- Form W-2, Wage and Tax Statements,

- Form W-3, Transmittal of Wage and Tax Statements,

- Forms 1099-MISC, Miscellaneous Income, and

- Forms 1099-NEC, Nonemployee Compensation.

Automatic extensions of time to file Forms W-2 are not available. If you need assistance filing any of these forms for your employees, please contact us as early in January as possible. You might want to get a head start now on verifying or updating employee information like names, addresses and Social Security numbers.

Money Brief: IRS Interest Rates

Interest rates charged by the IRS will remain the same for the first quarter of 2021:

- 3% for overpayments (2% in the case of a corporation);

- 5% for the portion of a corporate overpayment exceeding $10,000;

- 3% for underpayments; and

- 5% for large corporate underpayments.

Money Brief: Newly Marrieds

If you got married in 2020, consider this quick checklist:

- Name and Address Changes — If you plan to change your name, be sure to notify the Social Security Administration. The name on your tax return must match the one on file with the SSA to avoid refund delays. To update your information, file Form SS-5, Application for a Social Security Card, available at SSA.gov, by phone at 800-772-1213 or at your local SSA office. If you changed your address, send the IRS Form 8822, Change of Address.

- Withholding Taxes — Ask your employer for a new Form W-4, Employee’s Withholding Allowance. Depending on how you choose to file, you may want to adjust your withholding amount. Check the IRS Withholding Estimator or give us a call to help you complete a new Form W-4.

- Filing Status — If you are married as of December 31, you are considered married for the whole year for tax purposes. And as a newly married couple, you can choose to file your federal income taxes jointly or separately next year. In most cases, filing jointly is typically more beneficial. But we can help you determine the best method for your personal situation.