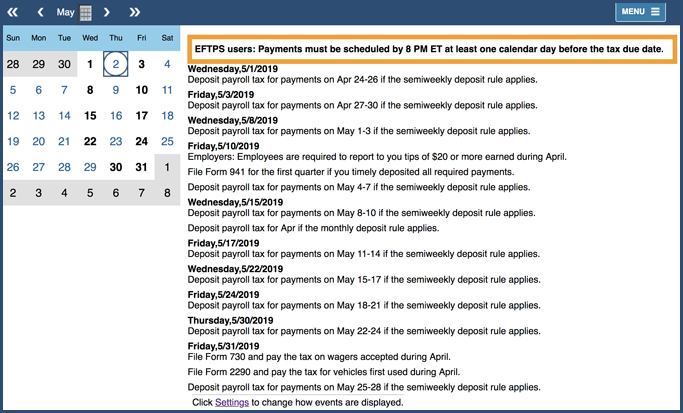

Stay on top of your business taxes this year with a free Tax Calendar from the IRS. It’s easy to customize this handy calendar tool to keep track of important dates and deadlines. For example, you can list dates when payroll deposits are due, or filing deadlines for 1099 and W-2 forms.

Here’s how to access the calendar (https://www.tax.gov/calendar/):

ONLINE – Simply bookmark the link in your web browser and refer to it each month. You can also skip through tabs for previous and upcoming months, as well as view last year’s key dates. A filter option allows you to sort and view tax dates and event types.

SUBSCRIBE – Subscribe to or download the calendar and incorporate it into your Microsoft Outlook, Apple Calendar, on your iPhone or iPad, or any other calendar that uses .ics format.

RSS FEED – You can have your Calendar reminders sent to your email inbox via RSS feeds one or two weeks in advance of when a form or payment is due.

Let Us Help!

Are you feeling a bit overwhelmed just trying to keep up with all the tax filing due dates? Let us help relieve some stress. We can manage your payroll filing, sales tax deposits and other tedious tasks for you. Contact us today to find out more. Call 706-632-7850 or email Jackie today.