People tend to underestimate how much they are going to need for retirement. Americans aged 65-74, for example, currently spend an average of $55,000 a year. But 60% of Baby Boomers who haven’t yet retired believe they will need less than that to live on during retirement — in fact, 44% believe they will need less than $35,000.

Unfortunately, those statistics are just two of the many disconnects we have over the need for retirement savings. Several recent studies find that many Americans, especially younger ones, might not be financially ready to retire when the time comes. Consider:

- 66% of working Millennials (those aged 22-37) have no retirement savings whatsoever, and only 5% are saving adequately for retirement.

- Thanks to the “Great Recession,” Millennials today generally earn about 20% less in wages, are less likely to own a home and have accumulated about half of the wealth of their parents at the same stage of their lives.

- 47% of Gen Xers (those aged 38-53) have no retirement account, and about 48% of those who do have less than $50,000 saved.

- Some reports say up to 45% of Baby Boomers (those aged 54-72) have zero retirement savings!

- For retiring Boomers, the average Social Security check is $14,000 a year. And only 23%-38% of Boomers expect any income from a private company pension plan.

The news doesn’t have to be all bad, though. Individual Retirement Accounts (both Roth and Traditional) remain a proven way to put away money on a tax-advantaged basis. And special “catch up provisions” allow taxpayers age 50 and older to sock away a little more each year. For 2019, your total contributions to all of your traditional and Roth IRAs is limited to $6,000 ($7,000 if you’re age 50 or older), or the total amount of your taxable compensation for the year (if it’s less than the limit). And you have until April 15, 2020, to make this year’s contribution.

Just call us at 706-632-7850 or email us to schedule an appointment — we’ll be happy to walk you through your retirement saving options!

Sources: National Institute on Retirement Security, CNBC, Business Insider, Forbes, MarketWatch, IRS

Term of the Week:

Tax-deferred

Tax-deferred refers to investment earnings, such as interest, dividends or capital gains, that accumulate tax-free until the investor takes the profits — at which time income taxes and capital gains taxes come due. The most common types of tax-deferred investments are individual retirement accounts (IRAs) and deferred annuities. Because no taxes are paid until you take a withdrawal, your money can grow at a faster rate than it would in a taxable product.

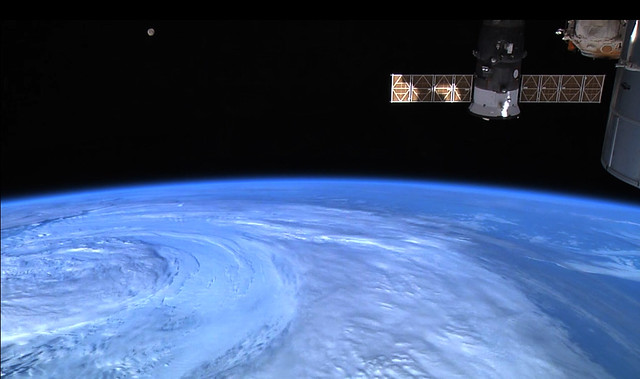

So You Want to Be an Astronaut

Adventurous (and rich!) folks can soon take a ride to the International Space Station (ISS). NASA has opened up the ISS to companies that fly “private astronauts” into space for a visit of up to 30 days. It will only cost you about $52 million to buy a seat on SpaceX, Elon Musk’s famous spaceship! (Source: CNBC)