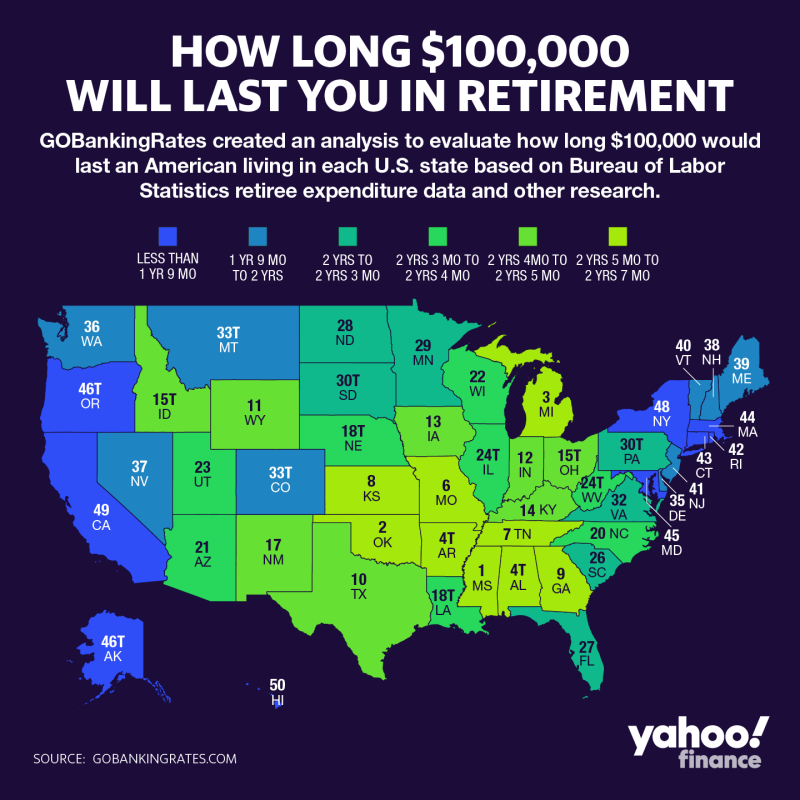

According to a recent study by GOBankingRates, Georgia ranks as one of the best states to retire if you’re trying to stretch your nest egg.

If you have $100,000 saved, for example, you can expect to live off that for 877 days in Georgia (roughly 2-1/2 years). The study considered the average total expenditures for people aged 65 and over, as well as the cost of living index in each state.

The cheapest state to retire is Mississippi (946 days), while the most expensive is Hawaii (428 days). The national average is 780 days, which equates to nearly $48,000 in annual expenditures.

Are You Ready to Retire?

Retiring in Georgia can be a good choice if your retirement savings are less than you’d like. More than half of American workers (52%) say they’re behind where they should be in saving for retirement, according to a study by Bankrate.com. Just 16% say they are right on track, and 11% feel they are ahead of where they should be in terms of saving. Another 20% of respondents say they don’t know if they’re on track or not. And a full 38% say they have never had a retirement account at all!

“Getting your retirement savings on track begins by fully utilizing your tax-advantaged retirement savings options, such as a workplace 401(k) and supplementing that with an IRA,” said Bankrate’s chief financial analyst, Greg McBride, CFA. “Aim to save at least 10% — and ideally 15% — of your income specifically for retirement. The best time to start is ‘today,’ and the worst time to start is ‘someday.’”

The tendency to be behind on retirement savings is highest among households with an annual income between $30,000-$49,999, with 62% responding that they are behind where they should be. That figure falls to 52% for households earning an income under $30,000 per year, and 48% for households with incomes of $80,000 or more.

We Can Help

No matter where you are in your retirement savings timeline, we can help you get started — or keep going — so you can retire wherever you want to and not worry about your savings running out. Call us today!

Sources: Yahoo! Money, GO BankingRates, BankRate