Several years later, the 2017 Tax Cut & Jobs Act continues to impact our taxes and the tax return forms we use. Keep these changes in mind when filing this year:

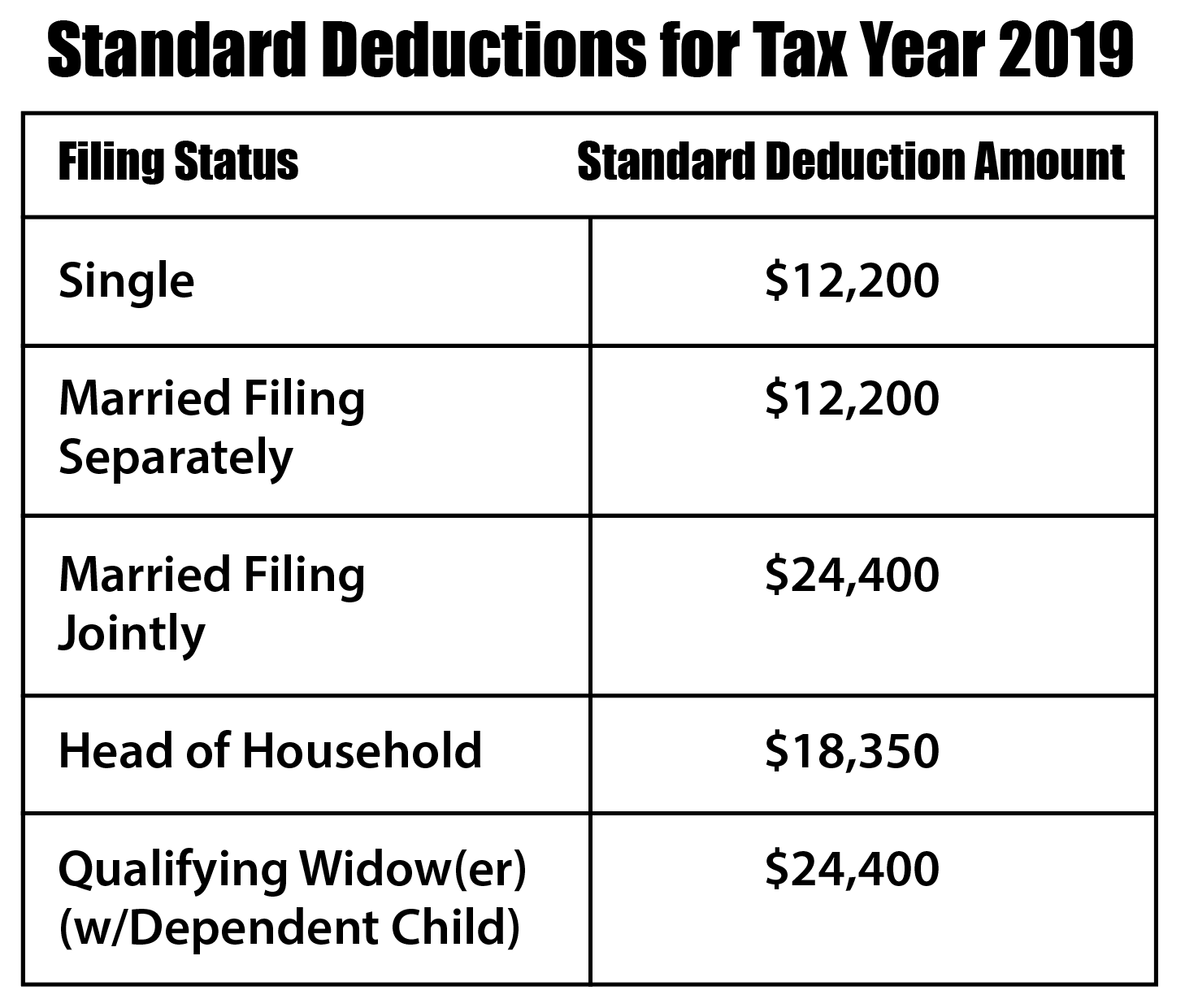

Standard Deductions — The standard deduction is a specified amount that’s subtracted from your AGI to help determine your taxable income. In many cases, it makes sense to use the Standard Deduction instead of itemizing. See the chart here for the 2019 rates.

Itemizing Considerations — To benefit from itemizing, your personalized deductions should be more than your standard deduction. This may be the case if you pay a mortgage, have high medical bills and/or make extensive charitable donations. If you choose to itemize, note that the 5% AGI limit on medical expenses has expired; the floor is now 10% for 2019. Also:

- The maximum deduction for charitable cash donations to qualified organizations is 60% of your AGI.

- Deductible mortgage interest is capped for loans up to $750,000.

- Moving expenses are no longer deductible for job relocation, unreimbursed employee expenses or employer-subsidized parking and transportation reimbursement.

- Deductions for casualty and theft losses, tax preparation costs and other miscellaneous deductions are no longer available.

- Alimony payments are no longer deductible (and if you receive alimony, you don’t have to claim it as income anymore).

Health Insurance Penalty — This rule has been repealed; there is no longer a penalty if you do not have health insurance coverage.

Capital Gains/Losses — In general, taxes on capital gains are lower unless you’re among those in the highest income brackets. Updated from last year, total capital gains (or losses) are once again directly entered on Form 1040 (Line 6) and not on Schedule 1.

Senior-friendly — A new tax return with a large, easy-to-read font has been created for taxpayers born before January 2, 1955 (IRS Form 1040-SR: US Tax Return For Seniors). It includes a standard-deduction chart, though Schedule A is still available for itemizing deductions as needed.

Of course, the deadline for filing your taxes has NOT changed! But we’re here to help you make sure they’re done correctly and on time. Just drop off your materials by March 27 so we can meet the April 15, 2020, tax-filing deadline. Or, let us know if we need to file an extension for you by calling 706-632-7850 or emailing us today.

Sources: Credit.com, Forbes