Each year, the IRS adjusts income thresholds, deduction amounts and tax tables for inflation using the Chained Consumer Price Index (C-CPI) as the basis for its changes. The adjustments recently announced will affect your 2021 deduction limits and tax brackets (for returns filed by April 2022).

You can deduct contributions to a traditional IRA if you meet certain conditions, including income limitations and whether you or your spouse are covered by a retirement plan at work. For 2021, you will see a small increase in your income limits for IRAs and Saver’s Credits (retirement savings contributions credits). Most other employee retirement plan contribution limits will remain the same, however. Note that IRA contribution limits remain unchanged at $6,000, as does the additional catch-up contribution limit of $1,000 if you’re 50+.

Traditional IRA Income Phaseout Ranges for 2021:

- $66,000-$76,000: Single taxpayers covered by a workplace retirement plan.

- $105,000-$125,000: Married couples filing jointly (when the spouse making the IRA contribution is covered by a workplace retirement plan).

- $198,000-$208,000: Married couples filing jointly (when the taxpayer not covered by a workplace retirement plan is married to someone who is covered).

- $0-$10,000: Married filing a separate return (when covered by a workplace retirement plan).

Roth IRA Income Phaseout Ranges for 2021:

- $125,000-$140,000: Single taxpayers and heads of household.

- $198,000-$208,000: Married couples filing jointly.

- $0-$10,000: Married filing separately.

Saver’s Credit Income Limits for 2021:

- $66,000: Married couples filing jointly.

- $49,500: Head of household.

- $33,000: Singles and married individuals filing separately.

Other Contribution Limits Unchanged for 2021

If you participate in a 401(k), 403(b) or 457 plan, or a federal Thrift Savings Plan, your contribution limit remains unchanged from 2020 at $19,500. If you’re age 50+, your catch-up contribution limit also remains unchanged at $6,500.

The limits for SIMPLE retirement accounts also remain unchanged at $13,500.

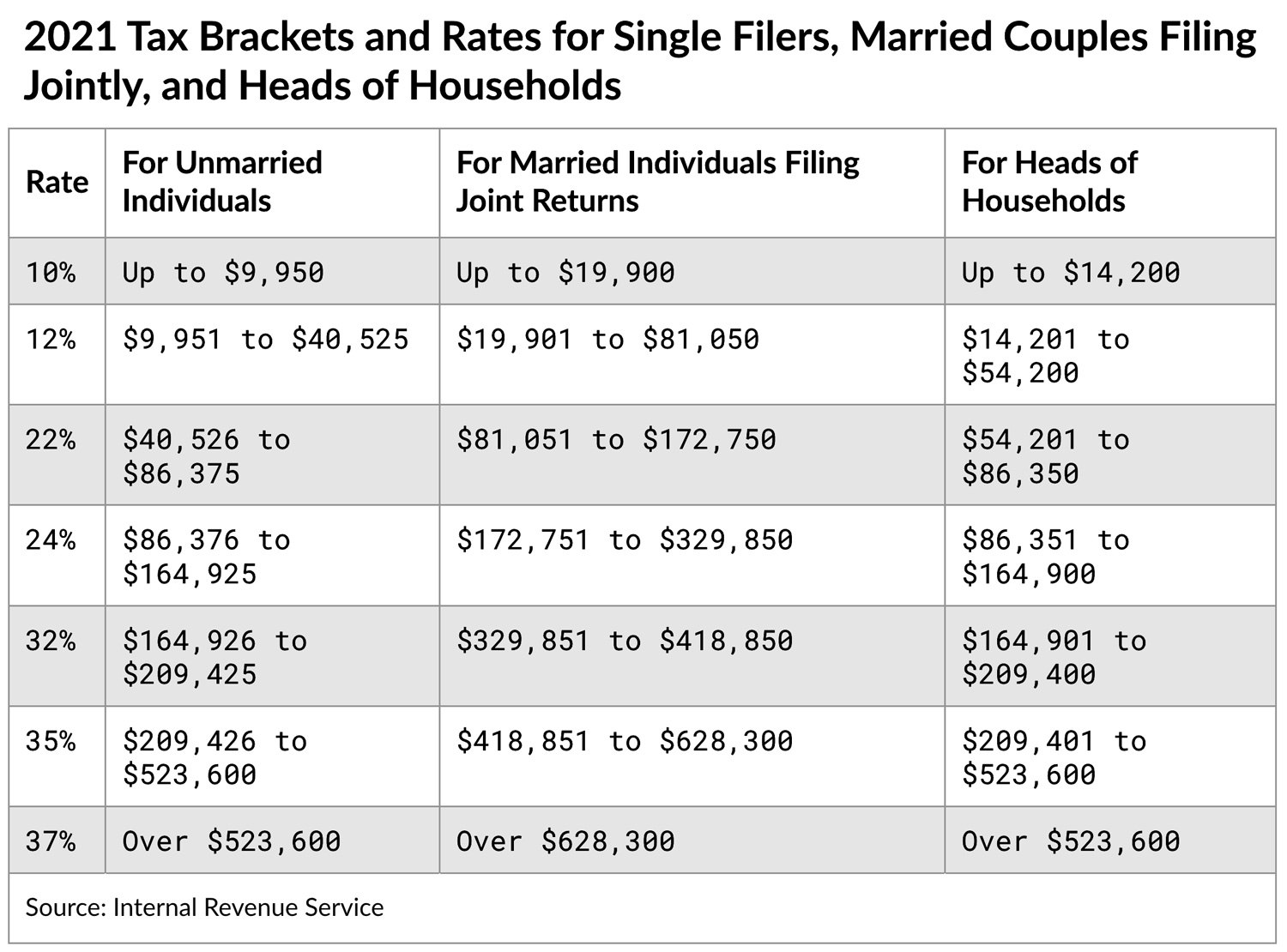

Tax Tables Adjusted for Inflation

For 2021, the top marginal income tax rate of 37% will affect taxpayers with taxable incomes of $523,600 and higher for single filers and $628,300 and higher for married couples filing jointly (see table below). Meanwhile, the Standard Deduction will increase to $25,100 for married individuals filing jointly or surviving spouses, $18,800 for heads of household, and $12,550 for unmarried individuals and married individuals filing separately.

The maximum Earned Income Tax Credit in 2021 for single and joint filers is $543 if the filer has no children, $3,618 for one child, $5,980 for two children, and $6,728 for three or more children. The maximum amount of the adoption credit increases to $14,440 (up from $14,300).

Exemption amounts for the alternative minimum tax will be $114,600 for married individuals filing jointly and surviving spouses, $73,600 for unmarried individuals, $57,300 for married individuals filing separately, and $25,700 for estates and trusts (all increased from 2020).

The qualified business income threshold under Sec. 199A will increase to $329,800 for married individuals filing jointly, $164,925 for married individuals filing separately, and $164,900 for single individuals and heads of household.

The annual gift tax exclusion remains at $15,000. The basic exclusion amount for determining the unified credit against the estate tax will increase to $11,700,000 for decedents dying in calendar year 2021.

Make Your Appointment Now

We’re currently taking appointments — both in-person and virtually — for year-end tax planning assistance. Contact Amber today (see box above) to set up your appointment. We can help you get ready to file your 2020 taxes, as well as plan ahead for 2021.

Source: Tax Foundation

Make Your Appointment

Don’t miss your chance to make a year-end tax planning appointment. Choose an in-person meeting (limited availability), or a Zoom or phone meeting. Please call Amber at 706-632-7850 or email her to set up a date today.

Money Brief: Employee Social Security Tax Deferral

If you are an employer, did you take advantage of President Trump’s August 8th memorandum allowing you to defer your employees’ portion of Social Security tax from September 1 through December 31, 2020? If so, keep in mind:

- To repay the deferred amount of the employee Social Security tax, you will need to withhold additional Social Security tax from your employees’ paychecks from January 1 through April 30, 2021.

- At year-end, when you report total Social Security wages paid to your employees on Form W-2, Wage and Tax Statement, you should include any wages for which you deferred withholding and payment of Social Security tax in box 3, “Social Security Wages,” and/or box 7, “Social Security Tips.” Do NOT include in box 4, “Social Security Tax Withheld,” any amount of deferred employee Social Security tax that has not been withheld.

- Any employee Social Security tax deferred in 2020 that is then withheld in 2021 and that was not reported on your 2020 Form W-2s should be reported in box 4, “Social Security Tax Withheld,” of Form W-2c, Corrected Wage and Tax Statement. On Form W-2c, you will enter tax year 2020 in box C and adjust the amount previously reported in box 4 of the Form W-2 to include the deferred amounts that were withheld in 2021. All Forms W-2c should be filed with the Social Security Administration, along with Form W-3c, Transmittal of Corrected Wage and Tax Statements, as soon as possible after you have finished withholding the deferred amounts.

- You will also need to provide your employees with copies of Forms W-2c.

- To report the amount of Social Security tax deferred, use lines 13b and 24 of 2020 Form 941, Employer’s Quarterly Federal Tax Return, which the IRS has revised. The instructions for the form have also been updated to explain these rules.

If you are an employee who had Social Security tax deferred, you should receive a Form W-2c from your employer(s). In some cases, you may need to file a Form 1040-X, Amended U.S. Individual Income Tax Return, to claim a credit for any excess Social Security tax withheld.

Please feel free to contact us with any questions you have regarding payroll tax deferrals.