Last week, the SBA released a revised Paycheck Protection Program (PPP) loan forgiveness application and a new EZ application. These new applications reflect the changes that were made to the PPP by the Paycheck Protection Flexibility Act of 2020, which passed on June 5.

You can access the new applications here:

Revised Application Changes

The revised PPP Loan Forgiveness Application includes several changes:

- If you own an S corporation, you cannot include health insurance costs when calculating payroll costs; however, retirement costs are eligible.

- Safe harbors for excluding salary and hourly wage reductions, as well as reductions in the number of employees, can be applied as of the date the loan forgiveness application is submitted. You do not have to wait until December 31 to apply for forgiveness to use the safe harbors.

- If you received your PPP loan before June 5, you can choose between using the original eight-week covered period or the new 24-week covered period.

New EZ Application Highlights

The new 3508EZ PPP Loan Forgiveness Application requires fewer calculations and less documentation than the full application. You can use the EZ application if you:

- Are self-employed and have no employees;

- Did not reduce the salaries or wages of your employees by more than 25% and did not reduce the number or hours of your employees; or

- Experienced reductions in business activity as a result of health directives related to COVID-19 and did not reduce the salaries or wages of your employees by more than 25%.

New SBA Rules Issued

The SBA also issued updated rules last week for determining payroll costs and owner compensation in calculating PPP loan forgiveness under the new 24-week period.

Employees — The original PPP legislation allowed loan forgiveness for payroll costs of up to $15,385 per employee over the eight-week period ($100,000 annualized). The new rule for the 24-week period is three times the eight-week limit for full loan forgiveness, or $46,154 per employee.

Owners — If you file Schedule C, Profit or Loss From Business, or Schedule F, Profit or Loss From Farming, your PPP forgiveness calculations have also changed. For the eight-week period, the calculation is 8 ÷ 52 × 2019 net profit, up to a maximum of $15,385. For the 24-week period, the forgiveness calculation is limited to 2.5 months (2.5 ÷ 12) of 2019 net profit, up to $20,833.

Other PPP Modifications

The SBA made a few other changes to account for the Payroll Protection Flexibility Act:

- The minimum term for PPP loans made on or after June 5 is now 5 years. For loans made before June 5, the minimum maturity remains at 2 years unless both the borrower and the lender agree to extend it to 5 years.

- The proportion of PPP funding that must be used on payroll costs to qualify for full forgiveness drops to 60% from 75%.

- The application deadline for PPP loans remains at June 30.

If you have any questions about the PPP loan changes, please don’t hesitate to contact us.

Source: Journal of Accountancy

Have You Been Counted?

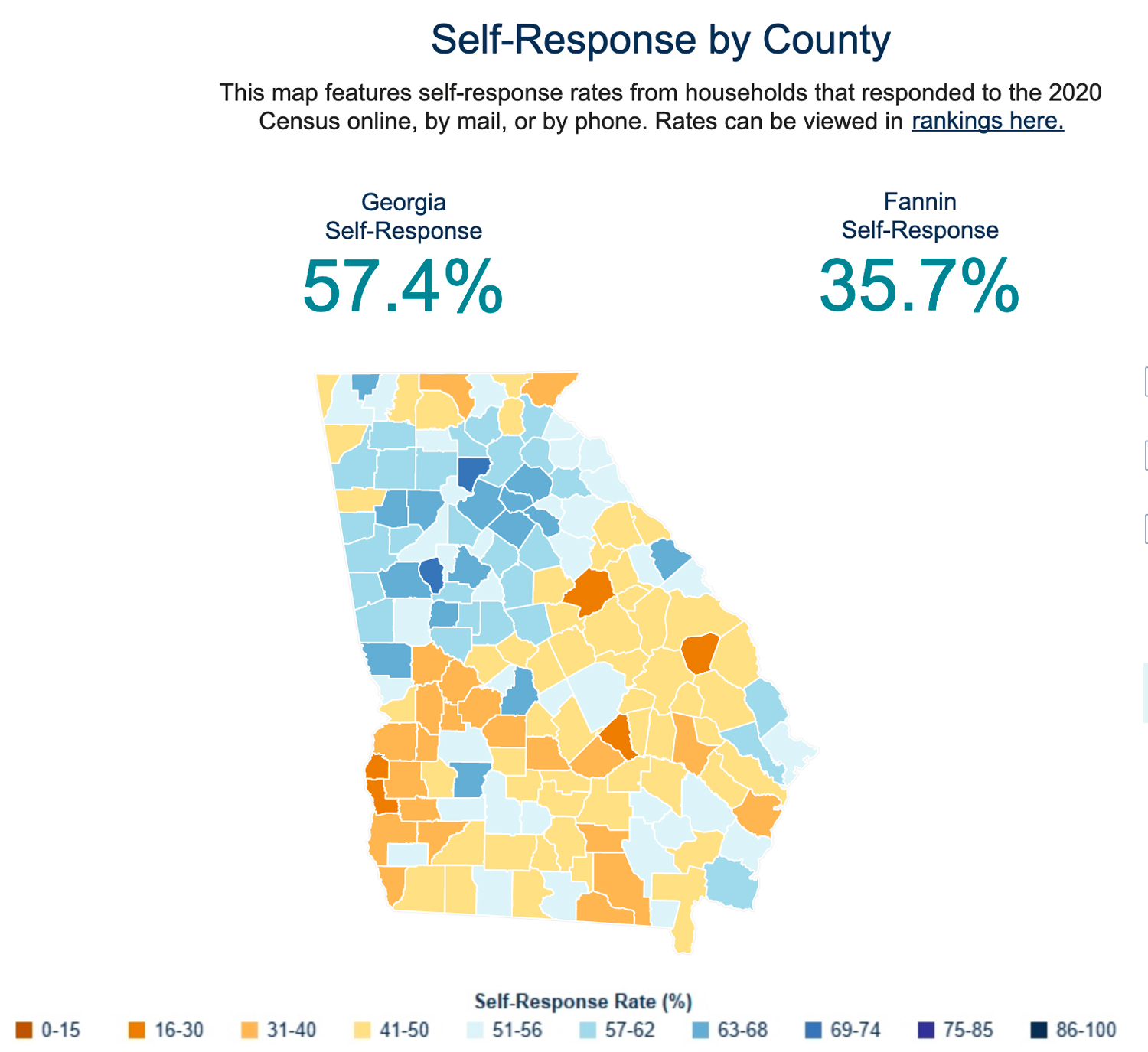

Fannin County is lagging behind in responses to the U.S. Census. While nearly 61.4% of all U.S. residents have responded, only 57.4% in Georgia and 35.7% in Fannin have. If you haven’t been counted yet, simply go to 2020census.gov, and fill out the easy form. The count is important so that Fannin receives its fair share in federal and state funding allocations. You can check out the response rates on this interactive map.

MONEY BRIEF

An extension to file is not an extension to pay. July 15 is the deadline to both FILE and PAY your taxes for 2019. If you need additional time, you can request an extension to FILE your taxes by October 15. However, you must still PAY any taxes due by July 15. Let us know if you need us to file an extension for you.

MONEY BRIEF

Estimated tax payments for tax year 2020, which were due April 15 and June 15, are now both due by July 15. You can visit IRS.gov/payments to pay electronically. The IRS offers two free electronic payment options where you can schedule your estimated federal tax payments up to 30 days in advance with Direct Pay, or up to 365 days in advance with the Electronic Federal Tax Payment System (EFTPS).

MONEY BRIEF

Employers may have tax credits available due to the coronavirus pandemic. To help explain the credits, the IRS created a PDF that breaks down the details of the Employer Retention Credit and the credits for paid sick and family leave. The easy-to-follow charts will help you determine whether you are eligible for the credits, the amount of the credits and which wages apply to the credits.