The loan, which is designed to cover 8 weeks of expenses, does not have to be paid back if at least 75% of the money is spent keeping or rehiring workers. The other 25% can be used for more payroll, rent, utilities and mortgage interest. Otherwise, it carries a 1% interest rate and must be paid back within 2 years.

While the Small Business Administration has approved more than 1.6 million loans totaling almost $350 billion since April 3rd, it has come with a host of technical glitches, an overload of applications and an exhaustion of money.

The good news is that Congress passed a new bill to replenish the PPP fund, which President Trump signed on Friday. The new law includes $310 billion in new funds, with $60 billion specifically targeted for smaller, community-based lenders and credit unions.

Following are some helpful Q&As adapted from a recent article in USA Today that we wanted to share with you:

Q: How long does it take to get a PPP loan?

A: With so many businesses applying, the SBA and banks have been overwhelmed. Some businesses have been approved for a loan in only a few hours, while others have waited several weeks … or still haven’t been approved. Once the loan is approved, however, you should receive the money within 10 days.

Note that if you’ve already applied for a loan but haven’t yet received an answer, you do NOT need to reapply. You’re already in the queue for the second round of PPP funding. But how quickly you’re approved often depends on whether your application is complete and accurate, and how your lender is prioritizing loan applications.

Click here for a sample PPP Loan Application.

Q: Why does it seem larger companies have been getting loans more quickly than smaller mom-and-pop stores?

A: Although the SBA processes the loans on a first-come, first-served basis, this requirement does not apply to lenders. So some banks have prioritized larger loans (with bigger fees) over smaller ones, and those from their “better” customers. To help address the issue, $60 billion of the new funding is scheduled to be set aside for community-based lenders, smaller banks and credit unions to assist smaller businesses.

Q: If I am self-employed or an independent contractor, am I eligible for a PPP loan?

A: Yes. Both types of workers may apply for the PPP. But in order for the loan to be forgiven, it must be tied to net profits from last year (not what you paid yourself), and not be equal to the salary you draw. Note that PPP applications for these types of workers did not start until April 10th, so you are further behind in line for loan approvals.

Q: When does the clock start running on PPP loans?

A: Immediately! The 8-week period to determine the amount of loan forgiveness begins counting on the day the money is deposited into your business bank account. So think twice about the loan if you can’t use the money right away (i.e., you don’t think you’ll be able to open in eight weeks). Payments are deferred for 6 months following the disbursement of the loan proceeds, while interest begins accruing immediately.

Q: What can I use the PPP funds for?

A: Payroll costs, healthcare benefits, mortgage interest payments, rent, utility, interest payments on debt incurred prior to February 15, 2020, and/or refinancing an SBA EIDL loan made between January 31, 2020 and April 3, 2020, all qualify. Note that you can provide raises or bonuses to your employees if you’re struggling to reach the 75% payroll threshold (as long as no worker earns more than $100,000 annually), but you cannot count independent contractors in your payroll numbers.

Q: What happens if I get a PPP loan, but still end up closing my business?

A: Due to the nature of the program, there’s no personal guarantee of collateral required. So if you have to declare bankruptcy, you should not have to repay the loan. However, if you stay in business but your sales are reduced, you will have to repay the loan.

Q: Can I apply for a PPP loan even if I’m currently making a profit?

A: Yes. The primary criteria for getting the loan is your company must have employed no more than 500 workers for whom it paid salaries and payroll taxes or paid independent contractors, and that it was operating on February 15th of this year. Loss of revenue is not a requirement, though the application form requires you to certify that “current economic uncertainty makes this loan request necessary to support the ongoing operations.”

The processes and requirements regarding the PPP can be confusing. If you need help applying or have questions about qualifying, please feel free to contact us. We’re here to help!

PPP and Other SBA

Loan Options

Click here for a downloadable PDF that further explains the PPP.

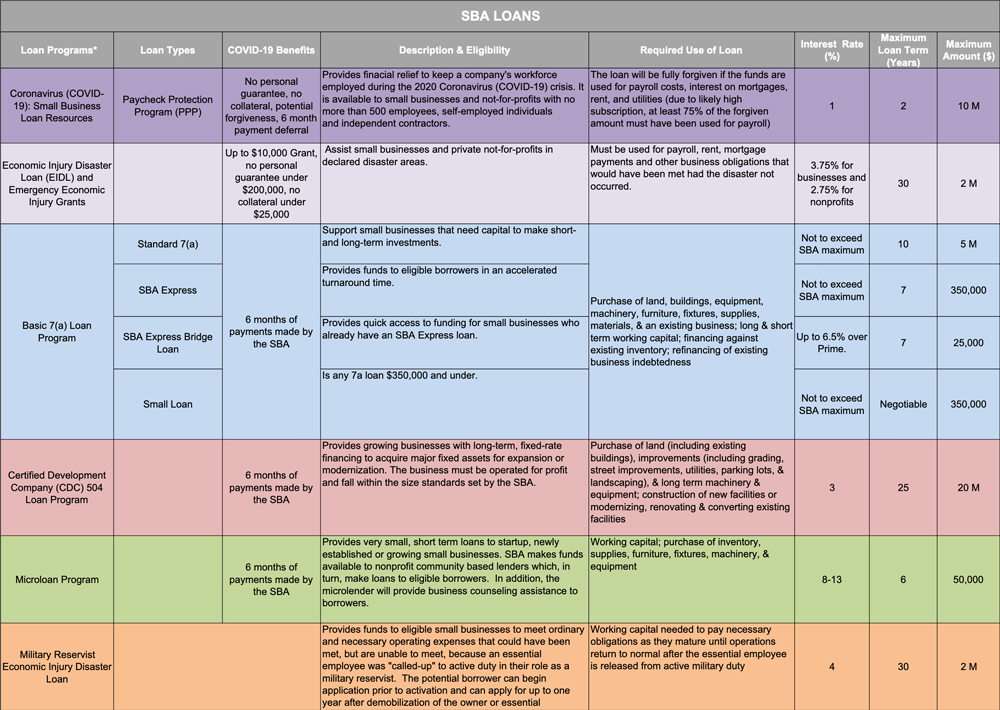

Click on the image below for a downloadable PDF comparing SBA loan options.

(source: AICPA)