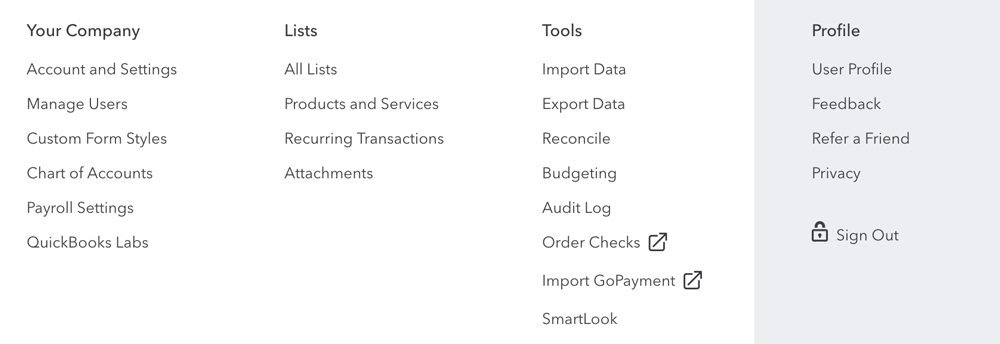

Start by clicking on Account and Settings, and then click on the various tabs to verify and/or edit:

Company — Check that all the information here is correct and up-to-date. It may not be if you’ve moved, changed a phone number, etc.

Billing & Subscription — Click here to change your plan (upgrade or downgrade) if your business has changed or you need different features.

Usage — Check your usage limits here for users, accounts, classes and locations.

Sales — Customize the design of your invoice, set preferred terms and delivery methods, add messages to your email forms and more.

Expenses — Choose whether to track expenses and items by customer, make expenses billable, use purchase orders and more.

Payments — Set up or connect an existing merchant account so customers can pay you via credit card and bank transfer.

Advanced — While some of the settings here are easy to complete, we can provide guidance on items like “Accounting method,” “Close the books” and “Tax form.”

We speak fluent “QuickBooks” here at Premier CPA Services. Just give us a call at 706-632-7850 and we’ll be happy to give you a lesson or two!

Updated QBI Rules for a Rental Real Estate Enterprise

The IRS recently updated qualified business income (QBI) rules to provide a safe harbor for certain taxpayers with a “rental real estate enterprise” (Sec. 199A). Under the new rules, a rental real estate enterprise is treated as a trade or business if at least 250 hours of services are performed each tax year. These hours are services performed by owners, employees and independent contractors and include time spent on:

- Maintenance, repairs, rent collection and payment of expenses,

- Provision of services to tenants, and

- Efforts to rent the property.

Note that time spent in arranging financing, buying property, reviewing financial statements, and traveling to and from the property are NOT considered hours of service. Also, the IRS requires:

- Separate books and records for the rental real estate enterprise.

- Contemporaneous records such as time logs with details on hours spent, services performed and contractor names.

- An annual statement attached to the tax return.

There are other rules and limitations, so be sure to talk with us about your specific situation.