With QuickBooks, you can easily find out the information you need.

First stop is the “Dashboard,” which you see every time you log in. The Dashboard contains a graphic in the upper left corner that tells you how many invoices are overdue and unpaid. Click on the colored bar labeled “OVERDUE INVOICES,” and you’ll see a list of these invoices.

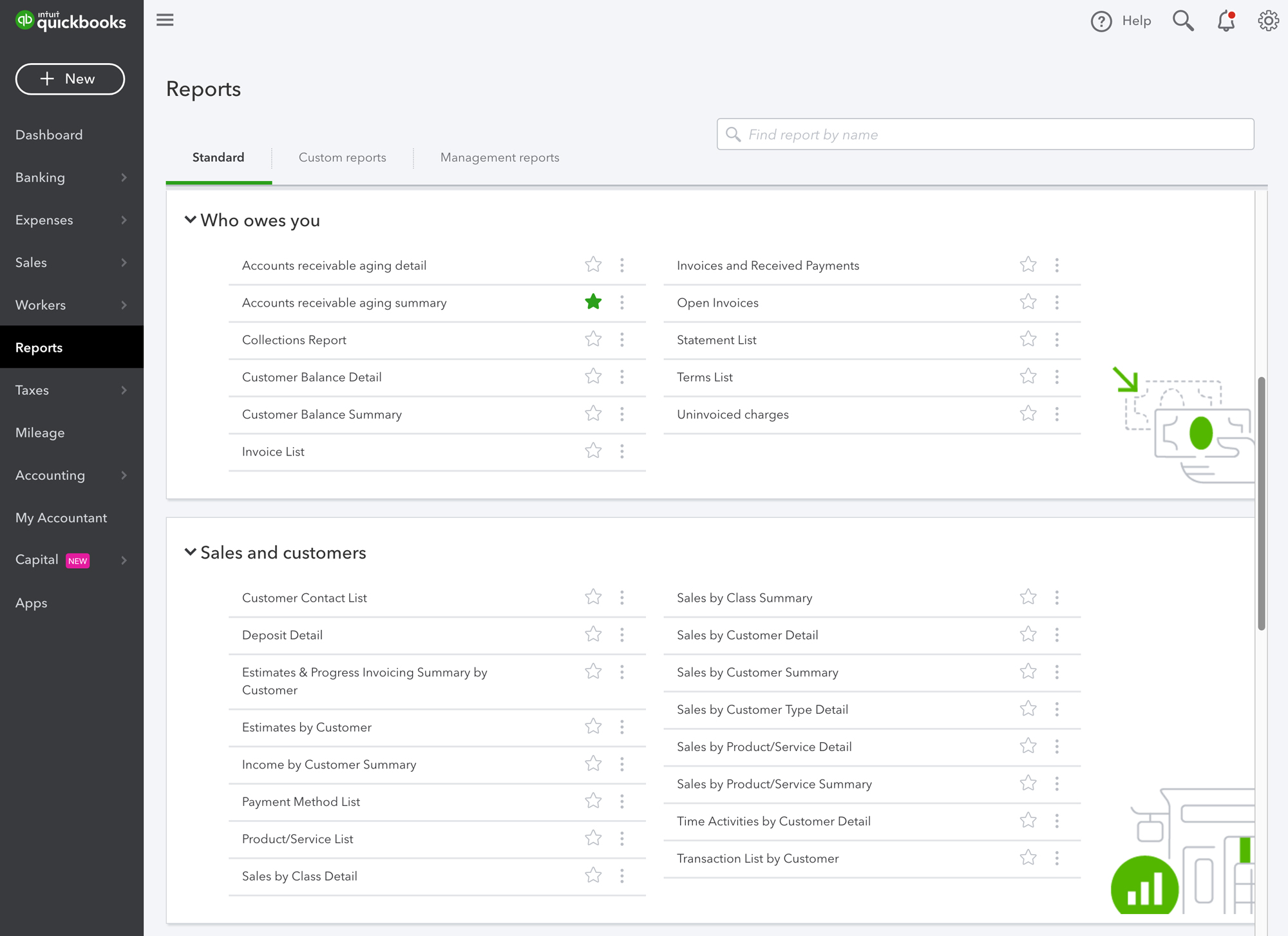

For more detailed info, however, you’ll want to click on “Reports” in the lefthand menu pane. Under the “Standard” tab, you can scroll down to the heading “Who Owes You.” In the following list, you can click on the star to make that report a favorite. And you can click on the three vertical dots next to the star to customize the report. What’s more, when you hover over the name of a report, you’ll see a small question mark within a circle. Click this to get a brief description of the report.

Several reports in this list provide detailed insights into your outstanding revenue. Consider running a few of these reports on a weekly basis — and customizing them as needed — including:

Accounts Receivable Aging Detail/Summary provides a list of invoices that are overdue, along with aging information. Be sure to note the “Open Balance” column.

Customer Balance Summary details how much each customer owes you.

Open Invoices lists invoices for which there has been no payment, with totals for each customer.

Uninvoiced Charges/Unbilled Time shows customer charges/time you haven’t yet invoiced.

Most of these reports should be self-explanatory and easy to understand. If you have any questions, however, we’re happy to help you with answers. Just give us a call!

IRS ANNOUNCES 2020 MILEAGE RATES

Beginning on January 1, 2020, the standard mileage rates for the use of a car, van, pickup or panel truck are:

- 57.5 cents per mile for business miles driven (down from 58 cents in 2019)

- 17 cents per mile driven for medical or moving purposes (down from 20 cents in 2019)

- 14 cents per mile driven in service of charitable organizations (same as 2019)