by Jonathan Bill | May 30, 2019 | IRS, Small Business, Tax Season

Our tax system is a “pay-as-you-go” process, which is all pretty straightforward when you receive a regular paycheck, and money is withheld on your behalf. But when you are self-employed — or earn certain other types of income — making estimated tax payments is your...

by Jonathan Bill | May 27, 2019 | IRS, Tax Season

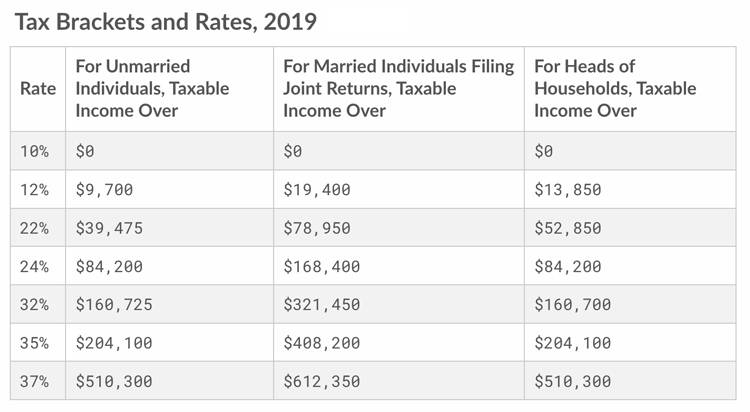

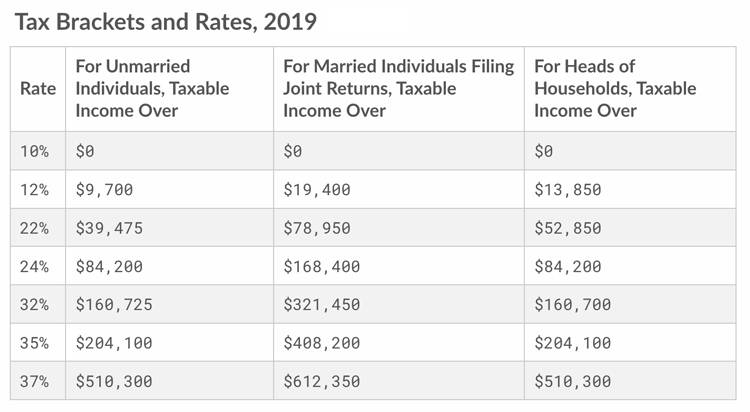

Sounds pretty scary, doesn’t it? Well it is. Each year, the IRS makes adjustments for inflation to more than 40 different tax provisions. The idea is to prevent what is known as “bracket creep.” Without these annual adjustments, you could find yourself creeping into a...

by Jonathan Bill | May 20, 2019 | IRS, Tax Season

The Tax Cuts and Jobs Act (TCJA) was announced with much fanfare at the end of 2017. The Act amended the Internal Revenue Code of 1986, including reducing tax rates for businesses and individuals. It simplified personal tax by increasing the standard deduction and...

by Jonathan Bill | May 13, 2019 | General Info, IRS

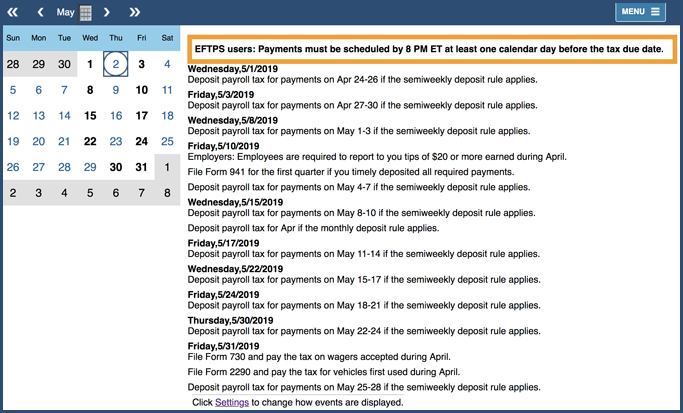

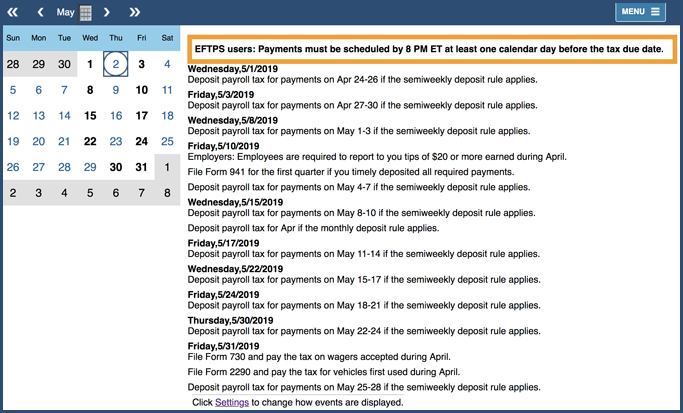

Stay on top of your business taxes this year with a free Tax Calendar from the IRS. It’s easy to customize this handy calendar tool to keep track of important dates and deadlines. For example, you can list dates when payroll deposits are due, or filing deadlines...

by Jonathan Bill | May 3, 2019 | General Info, Uncategorized

Whew! Tax season has finally wrapped up, and we can all breathe a sigh of relief. The hunt for paperwork is over … for now. If pulling your tax records together was a struggle this year, I’m going to suggest some simple tips for storing your financial records....