Many of you meet with Donna or I at tax time, when you’re closing out your year — or trying to figure out why your tax bill suddenly went up! But there are plenty of other times throughout the year that we can help — and maybe save you some money! Here are just a few:

#1 – Home-Related Issues

Because we are intimately familiar with your finances, we can help you understand how buying or selling a home will impact your income, taxes and financial strategies. This also applies to renting out your home or cabin, whether it’s through a local property management company or via Airbnb or VRBO. There are many tax considerations that go into renting, including paying sales & lodging taxes and earning additional income.

#2 — Children

If you’re having a child (or adopting one), you know that your expenses will be impacted. But so will your taxes, most likely in a positive way. We can help you maximize any tax credits or exemptions you may be entitled to, as well as guide you on college savings through tax-advantaged vehicles like 529 plans.

#3 — Marriage or Divorce

While these are both very personal events, you’ll find the government is more involved than you realize! Changes in your life situation will obviously change your tax filing status and could put you in a different tax bracket. In the case of divorce, we can help you understand the tax implications of future alimony payments before you go into negotiations.

#4 — Large Purchases

If you’re considering a major purchase (e.g., boat, RV, home addition), we can help you consider the best ways to pay for it. For example, if you’re selling stock to make the purchase, will you be liable for capital gains? Is a home equity loan your best option for remodeling your home? And which home remodeling receipts do you need to save?

#5 — New Job

If you’re considering a new career opportunity, keep us in the loop. We can help you determine proper withholding amounts, as well as possible write-offs and deductions, such as mileage, education expenses and 401(k) contributions.

#6 — New Business

Many of our clients are business owners, whether they’ve purchased an existing business or are starting from scratch. We can help you make some smart decisions with regard to business loans, employee payroll and taxes, budgeting for expenses and getting started with software like Quickbooks. We can also help you choose the most-advantageous entity for your new business — LLC, an S Corp or a C Corp.

Remember, we are your CPAs all year long, not just at tax time. Please call or schedule an appointment today, and let us help you make those important decisions in ways that benefit you, your family and your business!

Jackie & Donna

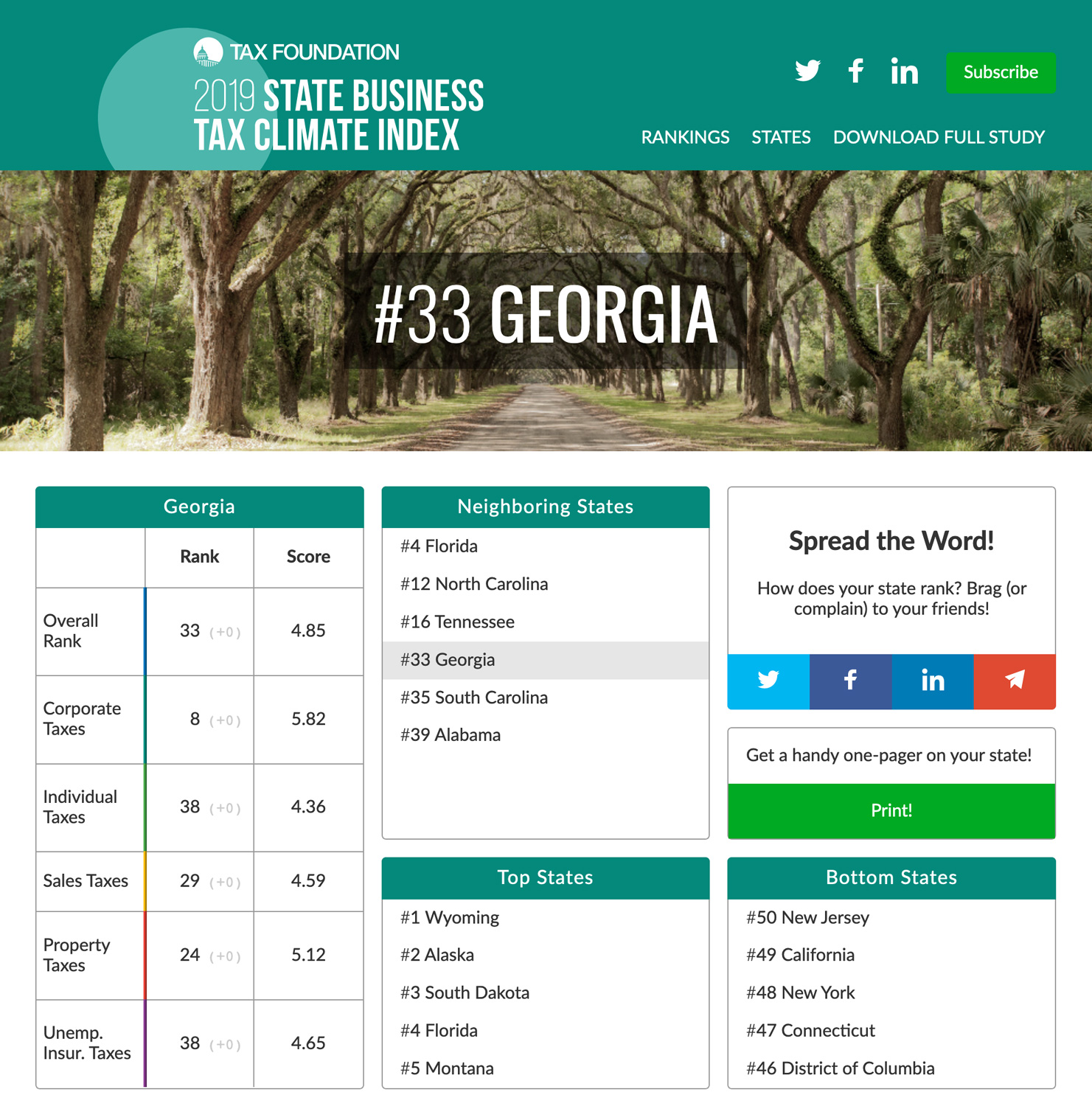

Georgia Business Tax Climate

Georgia currently ranks 33rd on the Tax Foundation 2019 Index. However, the state’s business tax climate can be expected to improve and Georgia taxpayers should see lower tax rates next year once reform kicks in.

Click on image to enlarge.