As promised, we have put together a checklist to help you pull together your tax preparation materials for 2020. With all of the CARES Act, Payment Protection Program loan and other changes to tax law last year, we expect plenty of questions and confusion.

Please click the images below to download a copy of the checklist (personal or business). If you prefer, we can email it to you (just call or email Amber at amber@premiercpaservices.com to request your copy).

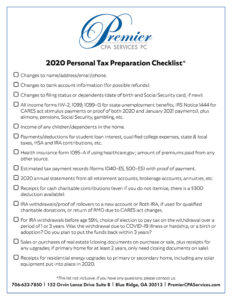

2020 Personal Tax Preparation Checklist

2020 Business Tax Preparation Checklist

Remember: We’re back open on Fridays now to handle the busy tax preparation season. Please contact us with any questions or concerns you may have.

Money Brief: Where’s My Money?

If you have not yet received your second Economic Impact Payment, you can check the status at irs.gov/coronavirus/get-my-payment. Direct deposit began on January 4, with mailed checks following that. You’re eligible for the new stimulus payment of up to $600 for individuals or $1,200 for married couples, and up to $600 for each qualifying child if:

- You are not claimed as a dependent on someone else’s income tax return.

- Your adjusted gross income for 2019 is up to $75,000 for individuals or up to $150,000 for married couples filing jointly and surviving spouses (payments are reduced or eliminated for filers with income above those amounts).

EIPs are an advance payment of the Recovery Rebate Credit, which will appear on the 2020 Form 1040 or Form 1040-SR.If you have not received your full payment by the time you file your 2020 tax return, you may claim the Recovery Rebate Credit on your tax return. The credit is figured like the Economic Impact Payment, except that the credit eligibility and the credit amount are based on the 2020 tax year information, including income.

Money Brief: 501(c)(4) Applications

The IRS is requesting organizations that want to file Form 1024-A, Application for Recognition of Exemption Under Section 501(c)(4), to file electronically. This will make the application easier to complete and reduce errors, while shortening IRS processing time. The required user fee for Form 1024 is $600, which can be paid fee through pay.gov/public/home.

Money Brief: Tax Filing Season Begins Feb. 12

The IRS will begin accepting and processing 2020 tax year returns no sooner than February 12, 2021. The February 12 start date allows the IRS time for programming and testing following the recent tax law changes. The IRS urges taxpayers to file electronically with direct deposit to speed processing and refunds — nine out of 10 taxpayers should receive their refund within 21 days of when they file electronically with direct deposit (assuming no issues).

Money Brief: Feb. 1 Deadline for W-2s

If you are an employer, you must file Form W-2s and other wage statements by Monday, February 1, 2021. This is also the date Form W-2s are due to employees. Form 1099-MISC, Miscellaneous Income and Form 1099-NEC, Nonemployee Compensation, are also due to recipients on February 1, 2021. E-file is the quickest, most accurate and convenient way to file these forms. If we are filing these forms for you, please get your information to us ASAP.

Money Brief: UGA Business Webinars

Register today for one of UGA’s upcoming webinars discussing the new SBA funding programs. Discussions will include updates and changes to the new PPP, the Targeted EIDL advance, the SBA Debt Relief Program, and the Shuttered Venue Operators Grant program, among others.