by Jonathan Bill | Aug 26, 2019 | Biz Taxes, GA Taxes, IRS

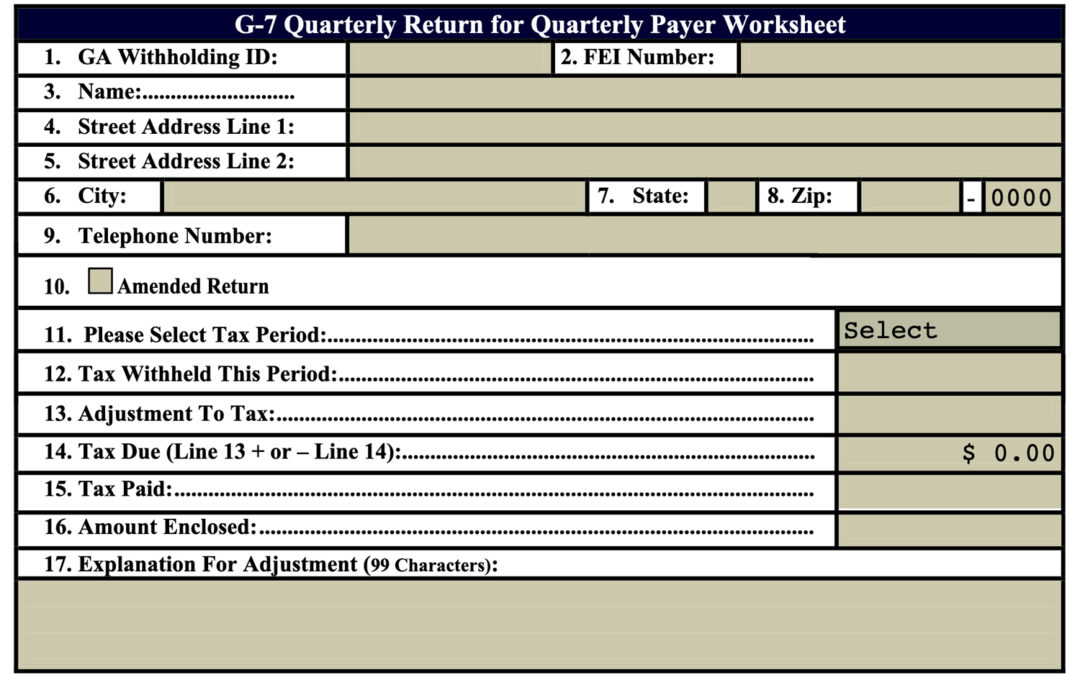

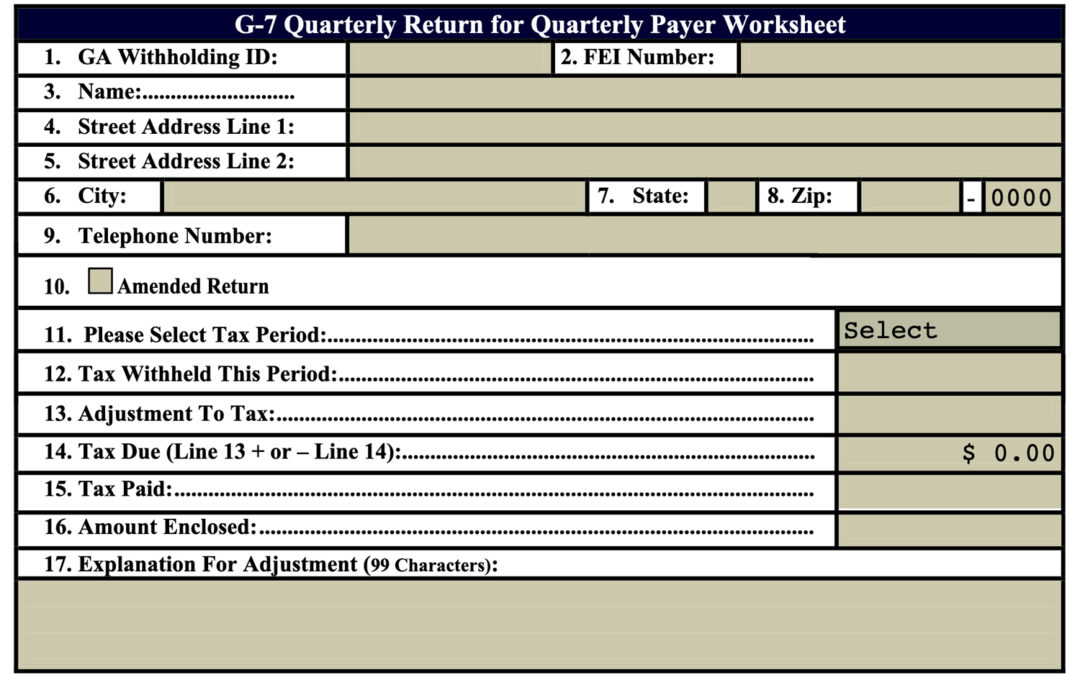

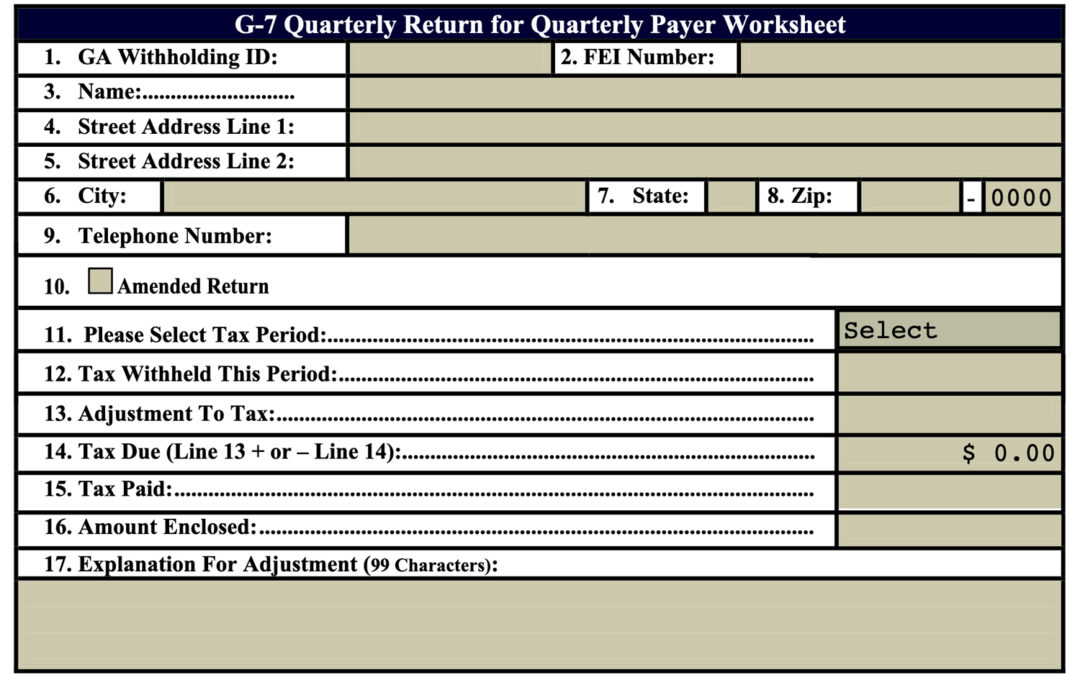

I your small business has employees, you need to withhold and pay Georgia AND Federal income tax on a regular basis. There are five possible payment schedules for withholding taxes in Georgia: Next-business-day Semi-weekly Monthly Quarterly Annually Your payment...

by Jonathan Bill | Aug 9, 2019 | Biz Taxes, IRS, Small Business

Don't forget! If you filed an extension, Corporate & Partnership returns are due 9/15 and Individual returns are due 10/15. Click here to email us today! In the battle against identity theft, the IRS is now permitting employers to use truncated (shortened)...

by Jonathan Bill | Jul 26, 2019 | Biz Taxes, Small Business

The State of Georgia collected a whopping $23.79 billion in tax revenue last year — $2.12 billion this past June alone. That $2.12 billion came from a variety of sources — everything from $1.04 billion in individual income tax to $164 million in motor fuel tax and...

by Jonathan Bill | Jun 17, 2019 | Biz Taxes, General Info

When you own rental property, your best tax deduction is usually depreciation. Unfortunately, the depreciation period for residential rental property is 27.5 years. That’s a long wait to deduct the full cost. Fortunately, there is a way to speed things up. In fact,...