by Jonathan Bill | Jun 19, 2025 | GA Taxes, Tax Season

You may notice a one-time rebate from the Georgia Department of Revenue (DOR) hitting your bank account or mailbox in the coming weeks, thanks to the 2025 Georgia Surplus Tax Refund passed by the Georgia Legislature and signed into law by Gov. Kemp. Funded by the...

by Jonathan Bill | Aug 21, 2023 | GA Taxes

As the new school year kicks off, it’s worth noting that there is a federal tax deduction for teachers and other education professionals who incur out-of-pocket classroom expenses. The deduction is for up to $300 in 2023, the same amount as in 2022. In the future, the...

by Jonathan Bill | Feb 28, 2023 | GA Taxes

In our last issue, we mentioned several commonly overlooked deductions that could save you money on your tax bill. But there is a new tax deduction for Georgia taxpayers that you may be unaware of: the unborn child deduction. Any unborn child with a detectable human...

by Jonathan Bill | Feb 1, 2023 | GA Taxes, Tax Season

We are scheduling appointments now through March 20 for tax season. You can set an appointment up today with Mimi and Jackie by calling us at 706-632-7850 or emailing our office manager Kimberly Mortimer at kmortimer@premiertaxsuccess.com. It is important to contact...

by Jonathan Bill | Mar 26, 2022 | GA Taxes, Tax Season

Thanks to a State of Georgia revenue surplus, legislators passed (and Governor Kemp signed) HB 1302, which provides Georgia taxpayers a refund of some or all of their 2020 income taxes due. Here’s what you need to know. Determining Your Refund Refer to your...

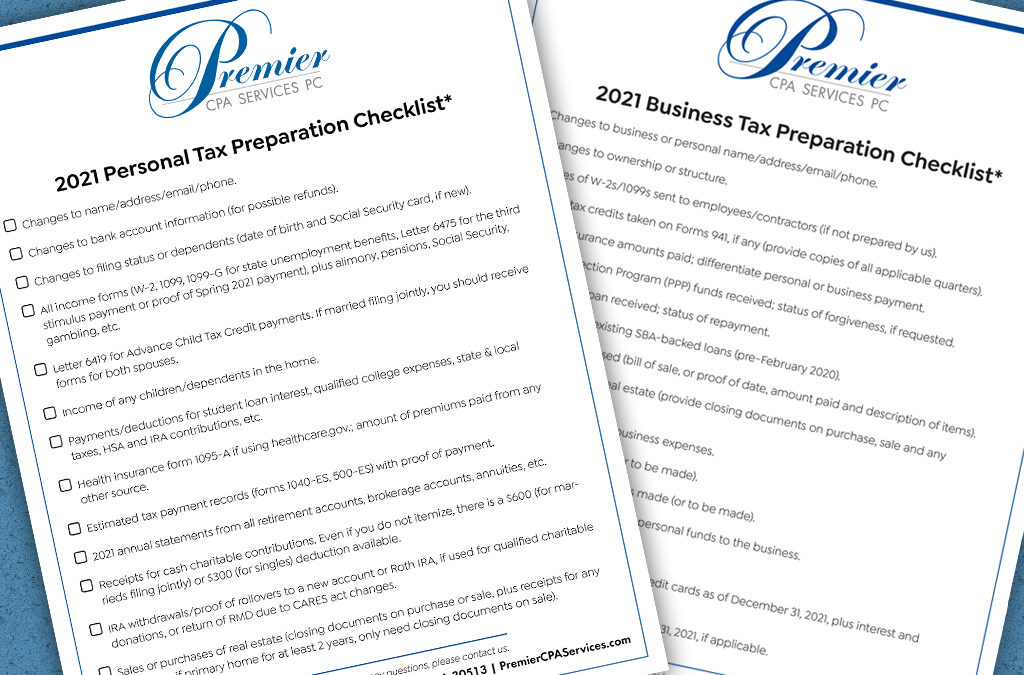

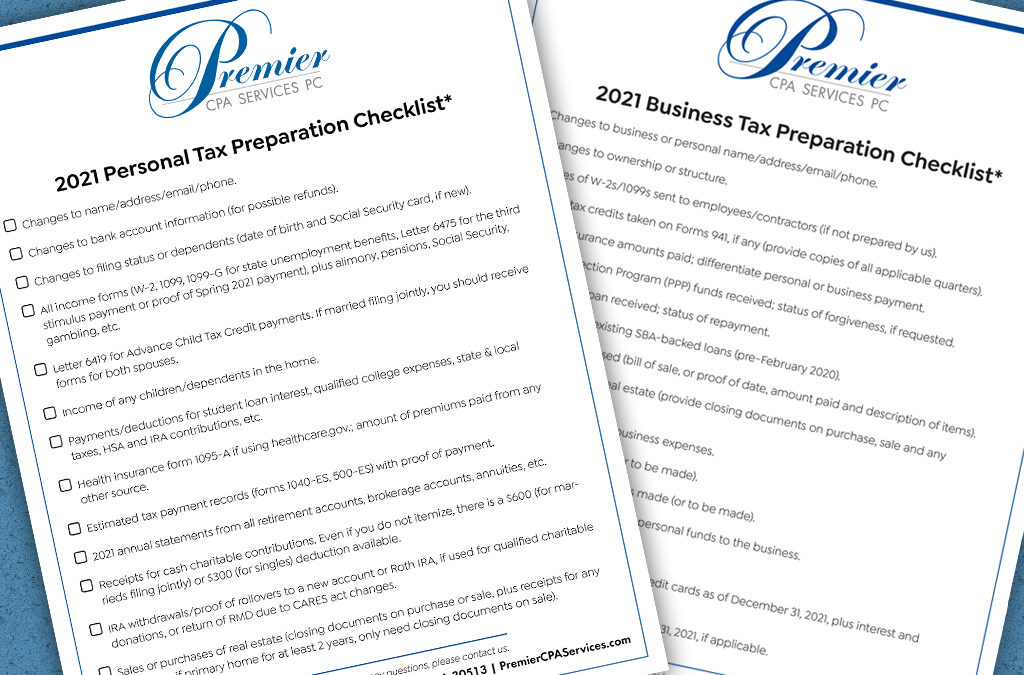

by Jonathan Bill | Jan 17, 2022 | Biz Taxes, GA Taxes, Tax Season

Help yourself (and us!) make tax preparation easier by using these handy Checklists to pull together your tax materials for 2021. With another year of tax law changes and new programs, these Checklists will ensure you’ve got everything you need to file. Please click...