by Jonathan Bill | May 19, 2021 | GA Taxes, Personal, Small Business

Beginning July 1, 2021, owners of certain short-term rentals must begin paying hotel taxes under House Bill 317, which was signed into law by Governor Kemp last month. The law requires that home rental companies, such as Airbnb and VRBO, collect Georgia’s $5-per-night...

by Jonathan Bill | Dec 30, 2020 | Biz Taxes, COVID-19, GA Taxes, Small Business

On December 27, 2020, President Trump signed into law the newest $900 billion COVID-19 relief bill. The legislation, part of the Consolidated Appropriations Act, 2021, provides additional pandemic relief and clarifies the deductibility of business expenses paid with...

by Jonathan Bill | Apr 13, 2020 | Biz Taxes, GA Taxes, Personal

Thanks to the Coronavirus Aid, Relief and Economic Security (CARES) Act, unemployment payment amounts will increase, more folks will qualify, and benefits will be available longer. Previously, only those workers who receive W-2s from their employer qualified for...

by Jonathan Bill | Apr 13, 2020 | GA Taxes, IRS, Personal, Small Business

The first round of stimulus money should start arriving this week for those who already have direct deposit set up with the IRS. But that’s just the beginning … the process could take several months to get money to every taxpayer — more than 100 million of us! Also,...

by Jonathan Bill | Nov 2, 2019 | GA Taxes, Personal

If you are passionate about school choice, you’ll want to know about Georgia’s Qualified Education Expense (QEE) Tax Credit. Launched in 2008, the program allows individuals, married couples and businesses to claim a dollar-for-dollar tax credit on their Georgia...

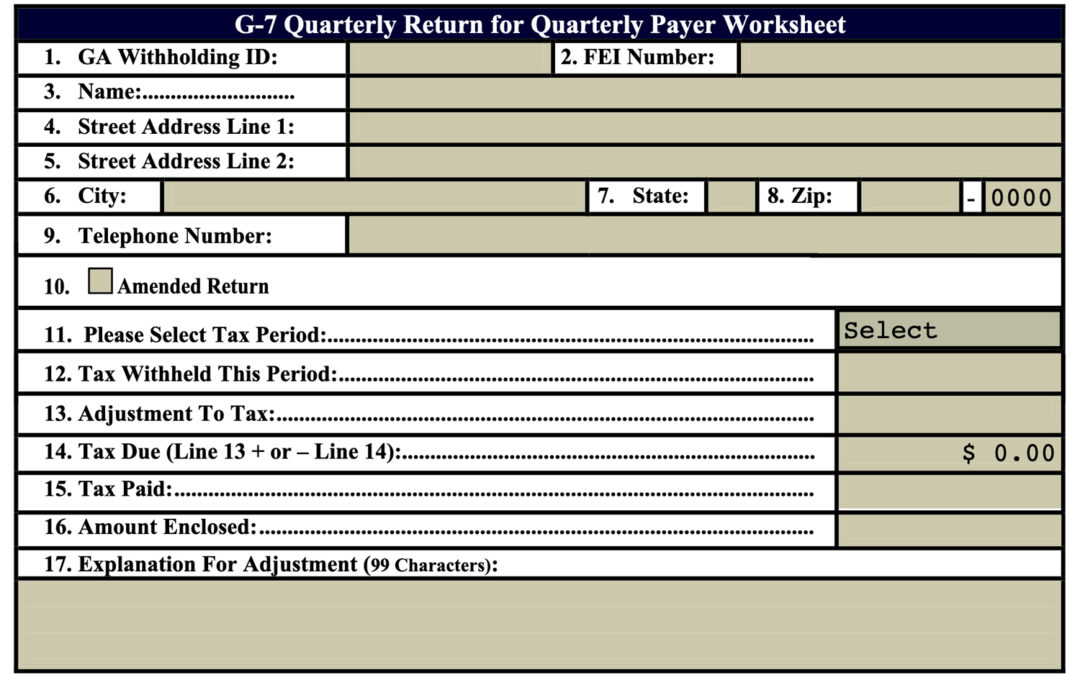

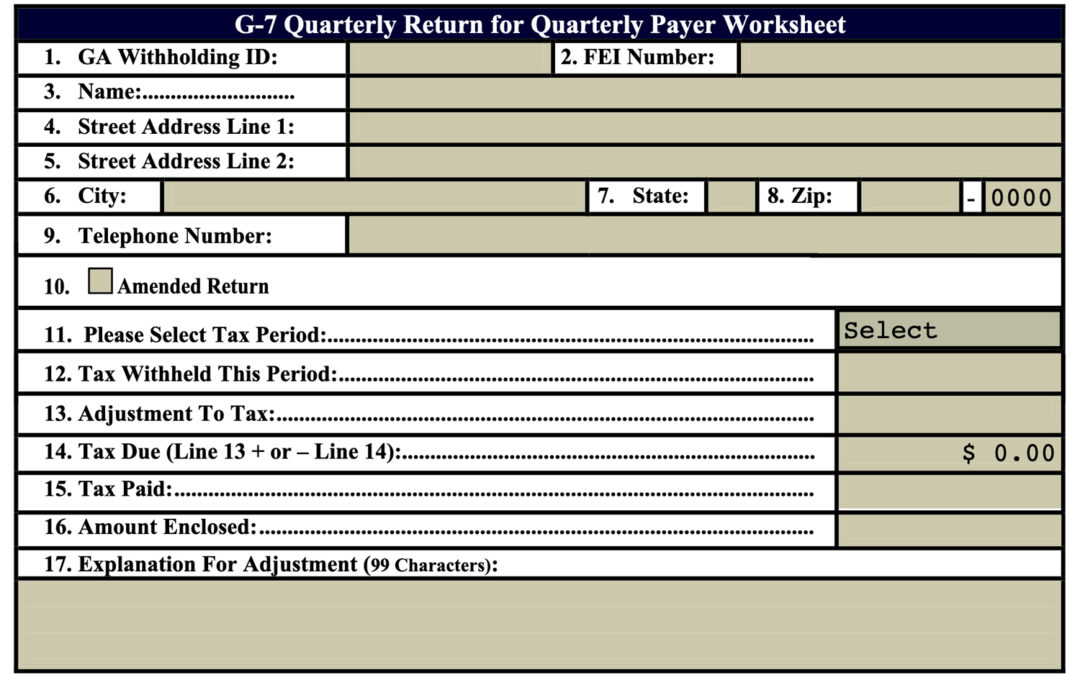

by Jonathan Bill | Aug 26, 2019 | Biz Taxes, GA Taxes, IRS

I your small business has employees, you need to withhold and pay Georgia AND Federal income tax on a regular basis. There are five possible payment schedules for withholding taxes in Georgia: Next-business-day Semi-weekly Monthly Quarterly Annually Your payment...