by Jonathan Bill | Mar 11, 2021 | COVID-19, Tax Season

Please note: The new American Rescue Plan Act signed by President Biden last week includes some items — including unemployment income and healthcare premium assistance — that affect 2020 tax returns. We will hold all tax returns until more info is released. Depending...

by Jonathan Bill | Feb 25, 2021 | COVID-19, Small Business, Tax Season

I f you’re a sole proprietor, independent contractor or owner of a very small business, now’s your time to apply for a Paycheck Protection Program (PPP) loan. Thanks to a temporary rule change by the Biden Administration, the SBA will ONLY accept applications for PPP...

by Jonathan Bill | Feb 12, 2021 | COVID-19, Tax Season

When you provide your paperwork to Premier CPA Services, you’re entrusting us to file your tax return accurately and efficiently. We use sophisticated software to handle the math, find common errors and flag missing information. But we also use our years of experience...

by Jonathan Bill | Jan 29, 2021 | Biz Taxes, COVID-19, Small Business, Tax Season

T/he SBA recently reopened the Paycheck Protection Program for both “First Draw” and “Second Draw” PPP loans for eligible small businesses. This second go-round is intended to make PPP loans more flexible, helpful and accessible, especially to hard-hit restaurants....

by Jonathan Bill | Jan 17, 2021 | Tax Season

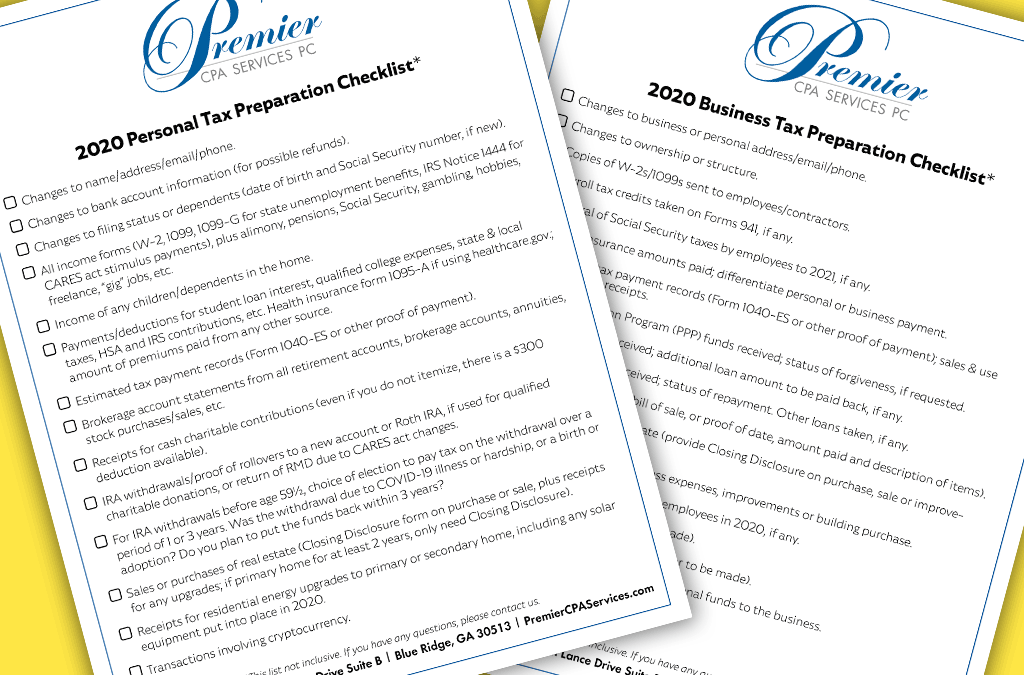

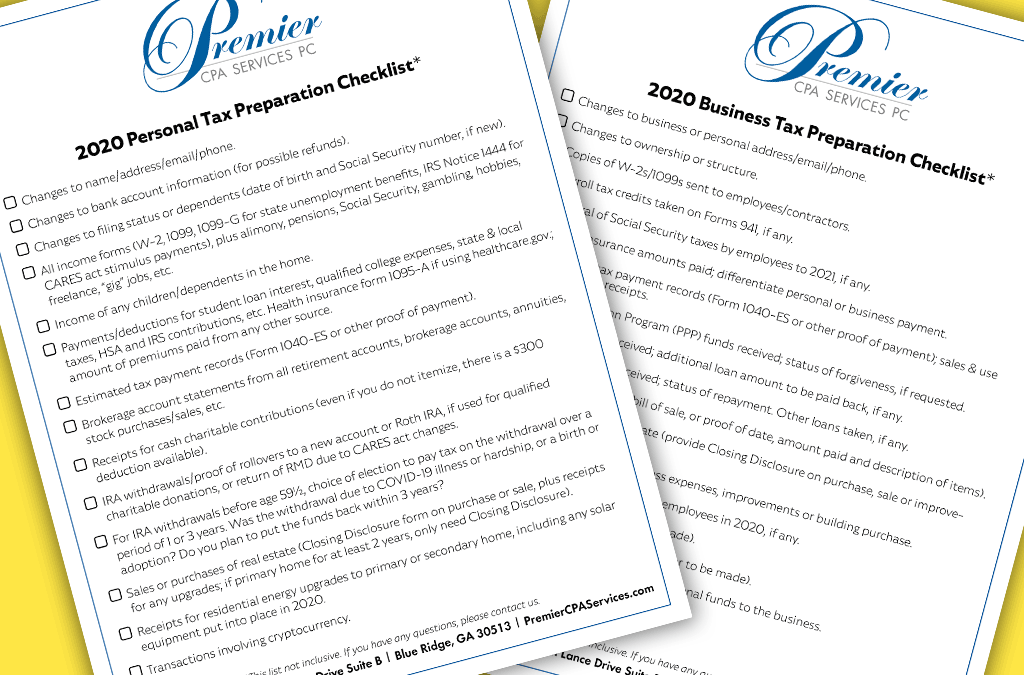

As promised, we have put together a checklist to help you pull together your tax preparation materials for 2020. With all of the CARES Act, Payment Protection Program loan and other changes to tax law last year, we expect plenty of questions and confusion. Please...

by Jonathan Bill | Dec 3, 2020 | COVID-19, Tax Season

I think most of us will be glad when 2020 is finally over so we can look forward to a new start in 2021. As the year winds down in the next four weeks, take some time to look over your finances. There may be a few things you can do before the end of the year to get...