Is Your “Side Hustle” a Hobby or a Business?

With a little extra time at home on your hands this year, you may have taken up a new hobby — maybe selling photographs, creating skin-care products or trading antiques — whether for fun or to make a few extra bucks. But is it just a hobby? Maybe you’re thinking it could turn into a new business venture. What’s the difference? And how does it affect your taxes?

Working from Home? Here’s What You Need to Know About Taxes

Thanks to COVID-19, you may find yourself working from home — whether for the first time or more often than before. So can you claim a home office deduction when you file your 2020 tax return next year? First of all, if you are an employee, you are NOT eligible to claim the home office deduction. You may be able to deduct a few expenses, but these are very limited.

COVID-Related Payroll Tax Deferral Raises Questions

In an effort to reduce the burden on workers, President Trump signed a memorandum on August 8 providing for the deferral of payroll taxes from September 1 through December 31, 2020. The new rule defers the employee portion of the old-age, survivors and disability insurance (OASDI) tax and Railroad Retirement Act Tier 1 tax for those whose pretax biweekly wages are generally less than $4,000.

The Rules Keep Changing: What You Need to Know About PPP Loans

With new legislation being debated and constantly updated, it seems, the rules regarding Paycheck Protection Program (PPP) loans and loan forgiveness keep changing. So the current advice from experts is: Don’t rush into anything!

Tax Tips for Gig Workers

If you earn income through any type of “gig” work, you need to be aware of certain tax issues that may affect your situation.

Retirement Planning: Are Your Social Security Benefits Taxable?

If you are retired now or planning on retiring soon, you’ll need to determine if any of your Social Security benefits will be taxed. It’s an important part of figuring your income and expenses during this time of your life. Here’s how to determine if your Social Security benefits are taxable:

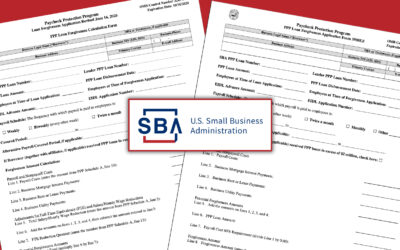

New & Easier PPP Loan Forgiveness Applications Now Available

Last week, the SBA released a revised Paycheck Protection Program (PPP) loan forgiveness application and a new EZ application. These new applications reflect the changes that were made to the PPP by the Paycheck Protection Flexibility Act of 2020 passed on June 5.

Good News: Positive PPP Changes Are Coming!

There’s good news if you took out a Paycheck Protection Program loan. The Paycheck Protection Program Flexibility Act — recently passed by the House & Senate and expected to be signed by President Trump — gives business owners more flexibility to use loan money and still get it forgiven.

Coming Due: PPP Loan Updates You Need to Know

On May 15, the SBA released its Payroll Protection Program Forgiveness Application. The Paycheck Protection Program is the forgivable loan program that allows small businesses to cover up to eight weeks of payroll costs, mortgage interest, rent and utilities.