Second Round of PPP Loan Funding Now Open

The SBA recently reopened the Paycheck Protection Program for both “First Draw” and “Second Draw” PPP loans for eligible small businesses. This second go-round is intended to make PPP loans more flexible, helpful and accessible, especially to hard-hit restaurants. Here’s how:

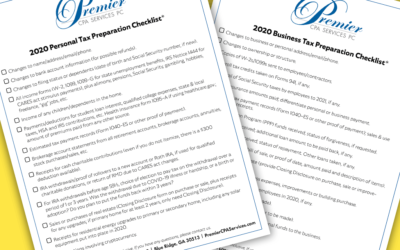

2020 Tax Preparation Checklists Now Available

As promised, we have put together two Checklists to help you pull together your tax preparation materials for 2020. With all of the CARES Act, Payment Protection Program loan and other changes to tax law last year, we expect plenty of questions and confusion.

2021 Appropriations Act Provides Additional Pandemic Relief

On December 27, 2020, President Trump signed into law the newest $900 billion COVID-19 relief bill. The legislation, part of the Consolidated Appropriations Act, 2021, provides additional pandemic relief and clarifies the deductibility of business expenses paid with forgiven Paycheck Protection Program (PPP) loans. Key provisions of the new law include:

8 Top Tax Tips for Year-end 2020

I think most of us will be glad when 2020 is finally over so we can look forward to a new start in 2021. As the year winds down in the next four weeks, take some time to look over your finances. There may be a few things you can do before the end of the year to get ready for the 2021 tax-filing season.

Take a $300 Charitable Deduction Thanks to the CARES Act

With the CARES (Coronavirus Aid, Relief, and Economic Security) Act, passed in April 2020, a certain portion of your charitable contributions may now be deductible for tax year 2020.

Need to Know: 2021 Retirement Plan Income Ranges and Tax Brackets Adjusted for Inflation

Each year, the IRS adjusts income thresholds, deduction amounts and tax tables for inflation using the Chained Consumer Price Index (C-CPI) as the basis for its changes. The adjustments recently announced will affect your 2021 deduction limits and tax brackets (for returns filed by April 2022).

Are You Taking Advantage of These 3 COVID-Related Business Tax Credits?

Put into place to help small business owners during the COVID-19 crisis, these tax credits may help you reduce your business’s financial burden:

PPP Loan Forgiveness: Is It Time to File?

Is it time to file for PPP loan forgiveness? The quick answer: Probably not yet. Ideally, you don’t want to file for loan forgiveness until the questions surrounding tax deductibility and automatic forgiveness are resolved.

How to Reduce Higher Education Costs with Tax Credits

If you, your spouse or your dependent child takes college classes — whether online or in-person, part-time or full-time — you may be able to offset some of the costs with tax credits. These credits reduce the amount of tax you owe. And if the credit reduces your tax to less than zero, you could even receive a refund.