I your small business has employees, you need to withhold and pay Georgia AND Federal income tax on a regular basis. There are five possible payment schedules for withholding taxes in Georgia:

- Next-business-day

- Semi-weekly

- Monthly

- Quarterly

- Annually

Your payment schedule depends on the average amount you withhold from employee wages over time. The more you withhold, the more frequently you need to make withholding tax payments. (Note: The IRS requires three deposit schedules: semi-weekly, monthly, or quarterly if your overall liability is $2,500 or less.)

Threshold dollar amounts for the different payment schedules may change over time, so check with us (or the Georgia Department of Revenue) at least once a year for the latest information. Due dates for payments are:

- Semi-weekly: Payments are due by Wednesday for amounts withheld on the preceding Wednesday, Thursday or Friday — or by Friday for amounts withheld on the preceding Saturday, Sunday, Monday or Tuesday.

- Monthly: Payments are due by the 15th day of the month following the month in which the tax was withheld.

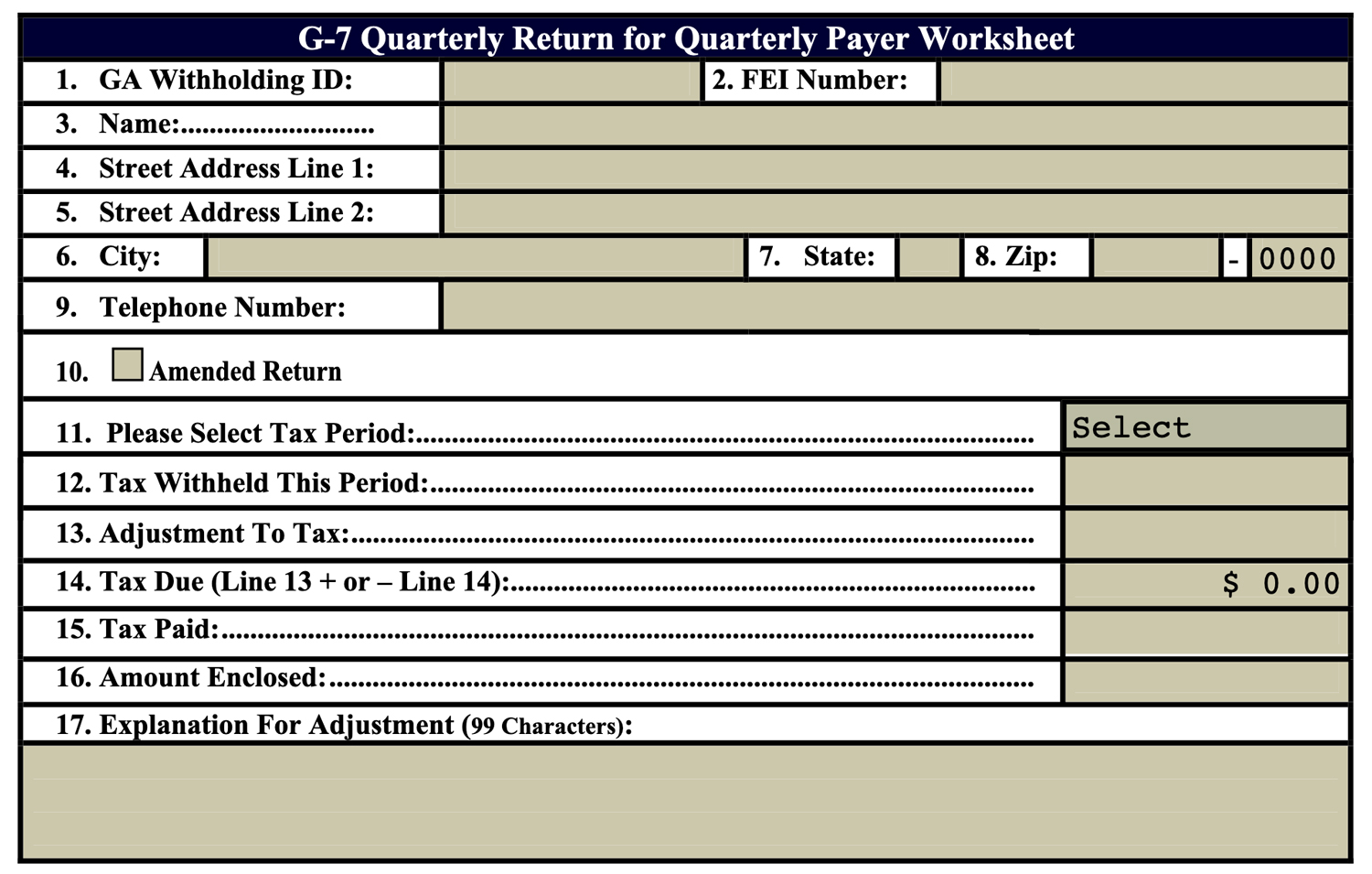

- Quarterly: Payments are due by the last day of the month following the end of the quarter.

- Annually: Payment is due by January 31st.

- April 30 for 1Q (Jan–Mar)

- July 31 for 2Q (Apr–Jun)

- October 31 for 3Q (July–Sep)

- January 31 for 4Q (Oct–Dec)

For specific dates and forms, please refer to the Georgia Department of Revenue website.

We Can Handle Your Payroll

Speaking of payroll, did you know that Premier CPA Services can handle your payroll processing? We can also take some of the pain out of your business reporting chores by taking care of Quarterly Payroll Reporting (Federal and State), as well as state and/or local sales tax reports on a monthly, quarterly or annual basis. Give us a call today to find out more about our small business services.