With only a few weeks left until the new year, it’s time to take a look at your year-end finances. There are a few things you can do before the calendar changes to get ready for the 2022 tax-filing season.

Your Year-End To-Do List

#1 Report changes — If you moved in 2021, notify the IRS of your new address. Name changes should be updated with the Social Security Administration.

#2 Renew expiring ITINs — If your Individual Taxpayer Identification Number is set to expire at the end of this year, be sure to renew it now. Visit the ITIN page for more details.

#3 Donate to charity — Even if you don’t itemize your deductions, the law now permits you to claim a limited deduction on your federal income tax returns for cash contributions made to certain qualifying charities. Singles and marrieds filing separate returns can claim a deduction of up to $300, while marrieds filing jointly can claim a maximum deduction of $600. Cash contributions include those made by check, credit card or debit card, as well as unreimbursed out-of-pocket expenses in connection with volunteer services to a qualifying charitable organization.

#4 Track Advance Child Tax Credit Payments — If you received advance payments in 2021, you will need to compare the amount of payments you received with the amount of the Child Tax Credit that you can claim on your tax return. If you received less than the amount that you’re eligible for, you’ll claim a credit for the remaining amount of Child Tax Credit. If you received more than you’re eligible for, you may need to repay some or all of that excess payment when you file. The IRS will send you Letter 6419 in January, which will provide the total amount of Advance Child Tax Credit payments that you received in 2021. Provide this letter to your tax preparer when you file.

#5 Check your Recovery Rebate Creidt — If you didn’t qualify for a third Economic Impact Payment (EIP) or did not receive the full amount, you may be eligible for the Recovery Rebate Credit. The IRS will send you Letter 6475 in January, which will provide the total amount of the third EIP and any Plus-Up payments that you received in 2021. You’ll need to provide this letter to your tax preparer when you file. Note that if you received the full amount of your third Economic Impact Payment, you don’t need to include any information about it when you file your 2021 tax return.

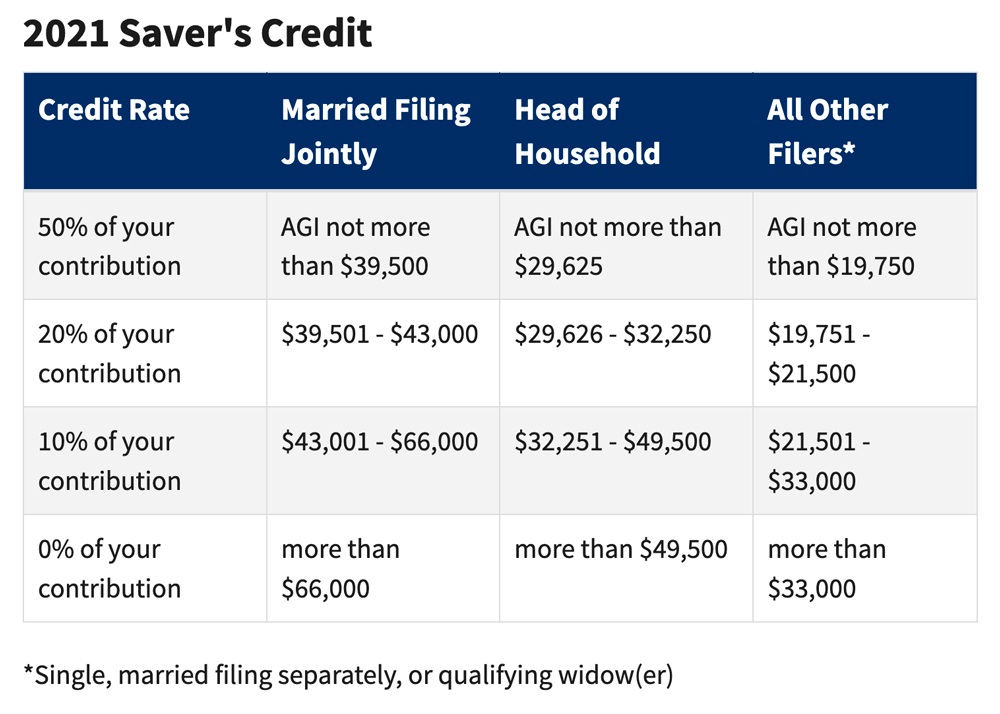

#6 Contribute to your retirement plan — Depending on your AGI, you may be able to take a tax credit of 50%, 20% or 10% of:

- Contributions you make to a traditional or Roth IRA;

- Elective salary deferral contributions to a 401(k), 403(b), governmental 457(b), SARSEP, or SIMPLE plan;

- Voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan;

- Contributions to a 501(c)(18)(D) plan; or

- Contributions made to an ABLE account for which you are the designated beneficiary.

Rollover contributions do not qualify for the credit. Also, your eligible contributions may be reduced by any recent distributions you received from a retirement plan or IRA, or from an ABLE account.

While the total salary deferral limit for 2021 is $19,500 ($26,000 if you’re 50+), only contributions of up to $2,000 qualify for the credit ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). See the chart below for details.

There is not a maximum age for traditional IRA contributions, so you can continue to contribute to a traditional IRA at any age as long as you earn compensation. Also, the minimum required minimum distribution (RMD) age is now 72.

#7 Verify your withholding — Use the IRS’s tax withholding estimator to make sure your withholding and estimated taxes align with what you actually expect to pay. Keep in mind that most income is taxable, including unemployment compensation. If you received non-wage income like self-employment income, investment income, taxable Social Security benefits and, in some instances, pension and annuity income, you may be in danger of underpaying your taxes, which could result in penalties. In this case, you can make an end-of-the-quarter estimated tax payment or have additional taxes withheld from your next few paychecks.

#8 Make business purchases — If you own a business, consider purchasing some business supplies now to take the deduction in 2021. Everything from printer ink to a new laptop or desk can qualify as an eligible business expense. Also make sure to keep your receipts related to the temporary 100% business deduction for food or beverages from restaurants. The Taxpayer Certainty and Disaster Relief Act of 2020 added a temporary exception to the 50% limit on the amount that businesses may deduct for food or beverages. The temporary exception allows a 100% deduction for food or beverages from restaurants, as long as the expense is paid or incurred in 2021 or 2022.

Prep Now for a Smoother Tax-Filing Season

While 2021 was not as crazy as 2020, there are still many changes that will affect next year’s tax filing. Start gathering your paperwork now, so you’re ready to go when your Forms W-2, Forms 1099-Misc and other income documents start arriving in the mail. If you have any questions, we’re here to help — just call 706-632-7850 or email us.

Money Brief: Jan. 31, 2022, Deadline

Year-end wage and tax statements will be due on January 31, 2022. Mark your calendar if you are required to file:

- Form W-2, Wage and Tax Statements;

- Form W-3, Transmittal of Wage and Tax Statements;

- Forms 1099-MISC, Miscellaneous Income; and

- Forms 1099-NEC, Nonemployee Compensation.

Automatic extensions of time to file Forms W-2 are not available. If you need assistance filing any of these forms for your employees, please contact us as early in January as possible. You might want to get a head start now on verifying or updating employee information like names, addresses and Social Security numbers.

Money Brief: Inflation Adjustments for Tax Year 2022

The IRS recently announced inflation adjustments for the 2022 tax year (for returns filed in 2023).

Standard Deduction Increases:

- To $25,900 for marrieds filing jointly (up $800).

- To $12,950 for singles and marrieds filing separately (up $400).

- To $19,400 for heads of household (up $600).

Marginal Rates:

- 37% for singles with incomes greater than $539,900 ($647,850 for marrieds filing jointly);

- 35% for singles over $215,950 ($431,900 for marrieds filing jointly);

- 32% for singles over $170,050 ($340,100 for marrieds filing jointly);

- 24% for singles over $89,075 ($178,150 for marrieds filing jointly);

- 22% for singles over $41,775 ($83,550 for marrieds filing jointly);

- 12% for singles over $10,275 ($20,550 for marrieds filing jointly).

- 10% for singles at $10,275 or less ($20,550 for marrieds filing jointly).

IRS Video Tip:

With more taxpayers and tax preparers working remotely, identity thieves are trying to use COVID-19 to scare and scam people out of their identities or money. Everyone should remember to take basic steps to protect themselves.