By law, you must pay income tax as you earn income — generally at least 90% of your taxes due. If you are an employee, your tax payments are typically paid by your employer in the form of withholding from your paycheck.

However, if some or all of your income is not subject to withholding, you should be making quarterly estimated tax payments. This typically applies if you are self-employed, an investor or a retiree — OR if your employer withholds taxes, but you receive additional income not subject to withholding, such as interest, dividends, capital gains, alimony, cryptocurrency and rental income.

3rd quarter estimated tax payments are due on Thursday, Sept. 15th.

Avoid an Underpayment Penalty

If you don’t pay enough in taxes throughout the year, you may owe not only additional taxes when you file your return, but also a tax penalty. In some cases, the penalty may apply if your estimated tax payments are late or even if you are due a refund.

You may need to make estimated tax payments if:

- You expect to owe $1,000 or more when your file your tax return.

- You are a business owner, sole proprietor, partner or S corporation shareholder.

- You make extra money via the “gig economy,” such as driving an Uber or selling photos at an art show.

To determine the estimated tax amount due, you must figure expected adjusted gross income, taxable income, taxes, deductions and credits for the year. It may be helpful to refer to your 2021 tax return as a starting point. You can use the Tax Withholding Estimator on the IRS website. Or feel free to contact us. We’ll be happy to help you determine the correct amount you owe, and file any necessary paperwork. To change your withholding, you can submit a new Form W-4 to your employer.

Be sure to make your estimated tax payments by the remaining due dates: Sept. 15, 2022 (3rd quarter), and Jan. 17, 2023 (4th quarter).

Extended Personal Tax Return Due Date Approaching!

Did you file an extension for your Personal Tax Return? If so, time is running short. The extension due date to file your 2021 return is October 15, 2022. Please bring your paperwork to us no later than September 15 so we can ensure your return is filed on time.

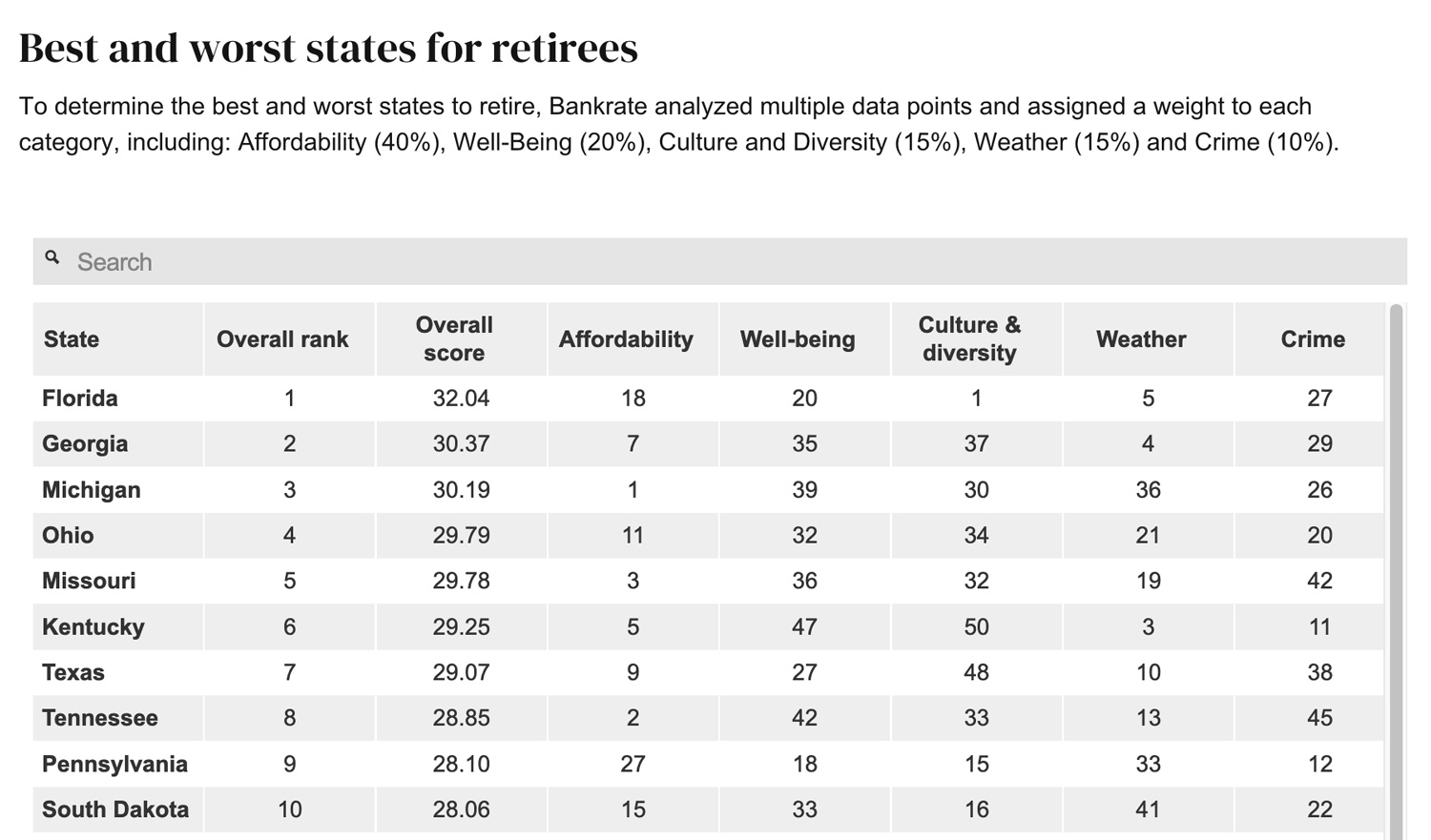

Georgia Ranks #2 for Retirement

In a recent analysis, Bankrate.com compiled a list of the best states to retire based on five categories: affordability, health & wellness, culture & diversity, weather and crime. While Florida ranked, predictably, as the best state for retirement, our own state of Georgia followed at #2. Here’s what they said about Georgia:

“For retirees considering a move to Georgia, affordability is one big selling point. The state combines a low cost of living and a light tax burden to rank No. 7 in affordability. Weather is another strong point. The state has an average annual temperature of 64 degrees, the fifth-warmest in the nation. Earthquakes are rare, and tornado risk is about average. The one downside is hurricanes — Georgia’s small coastline puts it at risk of tropical cyclones. Georgia places in the middle of the pack in our rankings for both wellness and crime. The state’s only weak spot is in the culture category — the Peach State has one of the nation’s lowest percentages of over-65 residents, and it ranks near the bottom in arts and entertainment establishments per capita, based on a Bankrate analysis of Census data.”

See the chart for the rankings of the top 10 states, and read the full article on Bankrate.com.