If you haven’t yet made a contribution to your IRA for 2021, you still have time. The deadline is the same as the tax-filing deadline: April 18, 2022. What’s more, if you plan to make a contribution by that date, you may be able to claim the deduction on your 2021 tax return.

Know Your Traditional IRA

An Individual Retirement Account (IRA) is a tax-advantaged personal savings plan that lets you set money aside for retirement. Generally, you can contribute up to $6,000 to your IRA for 2021. If you were 50+ by December 31, 2021, you can add another $1,000 to that limit. Depending on your status, your contributions to one or more traditional IRAs may be deductible up to the contribution limit or 100% of your compensation, whichever is less.

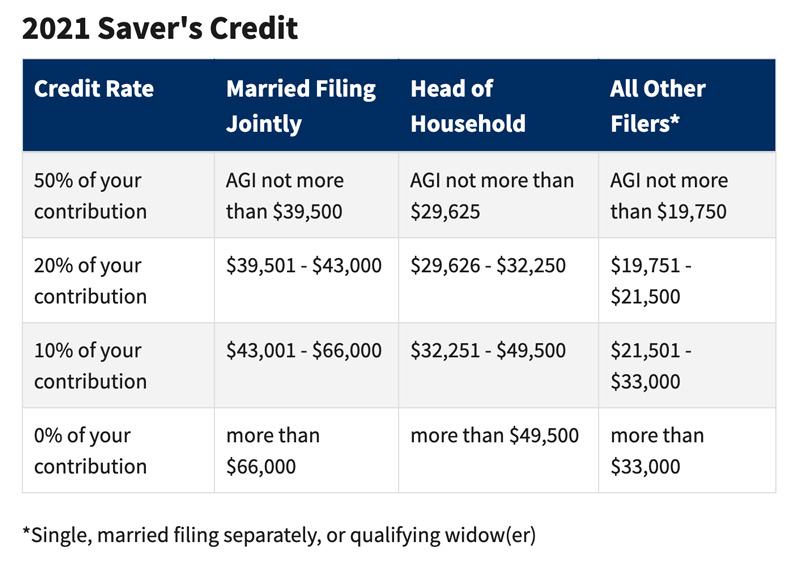

If you make contributions to employer retirement plans, such as a 401(k) or 403(b), an IRA, or an Achieving a Better Life Experience (ABLE) account, may also be able to claim the Saver’s Credit. Also known as the Retirement Savings Contributions Credit, the amount of the credit is generally based on the amount of your contributions, your adjusted gross income and your filing status (see the chart below).

Know Your Roth IRA

While you may contribute to a Roth IRA, you cannot deduct those amounts. However, any qualified distributions you take at retirement age are tax-free. Note that Roth IRA contributions may be limited based on your filing status and income.

Please don’t hesitate to call us at 706-632-7850 with any questions.

March 25th Deadline

March 25 is the last day we can accept materials to file your Personal Tax Return by the April 18 due date. If you’re running late, we’ll be happy to file an extension for you. Please bring your paperwork to our office during regular business hours, or drop it off in our after-hours dropbox. Our 2021 Personal Tax Preparation Checklist will help make sure you provide everything we need.

Remove Excess Salary Deferrals by April 15, 2022

If you contribute to a retirement plan at work, you are allowed a total of $19,500 (plus an additional $6,500 if age 50+) in salary deferrals. If you exceeded this limit in 2021, however, you must withdraw any excess deferral amounts, plus earnings, by April 15, 2022.

If you withdraw the excess salary deferrals, plus earnings, by April 15:

- Excess deferrals are taxed in the calendar year deferred (2021).

- Earnings on the excess are taxed in the year withdrawn (2022).

- Excess is not subject to the 10% early distribution tax, 20% withholding, or spousal consent requirements.

If you do NOT withdraw the excess salary deferrals, plus earnings, by April 15:

- Excess deferrals are taxed in the calendar year deferred (2021) and again in the year withdrawn.

- Earnings on the excess are taxed in the year withdrawn.

- Withdrawals may be subject to the 10% early distribution tax, 20% withholding, and spousal consent requirements.

If you made contributions to more than one retirement plan, you may have accidentally gone over the limit. If you’re not sure, contact us today for help determining this amount.