by Jonathan Bill | Nov 18, 2019 | Biz Taxes, IRS, Personal

Over the last couple weeks, the IRS has announced a few updates that will apply to the 2020 tax-filing season (for returns processed in 2021). Keep these changes in mind while planning your finances. Retirement Plan Contribution Limits Increased » The limit on...

by Jonathan Bill | Aug 26, 2019 | Biz Taxes, GA Taxes, IRS

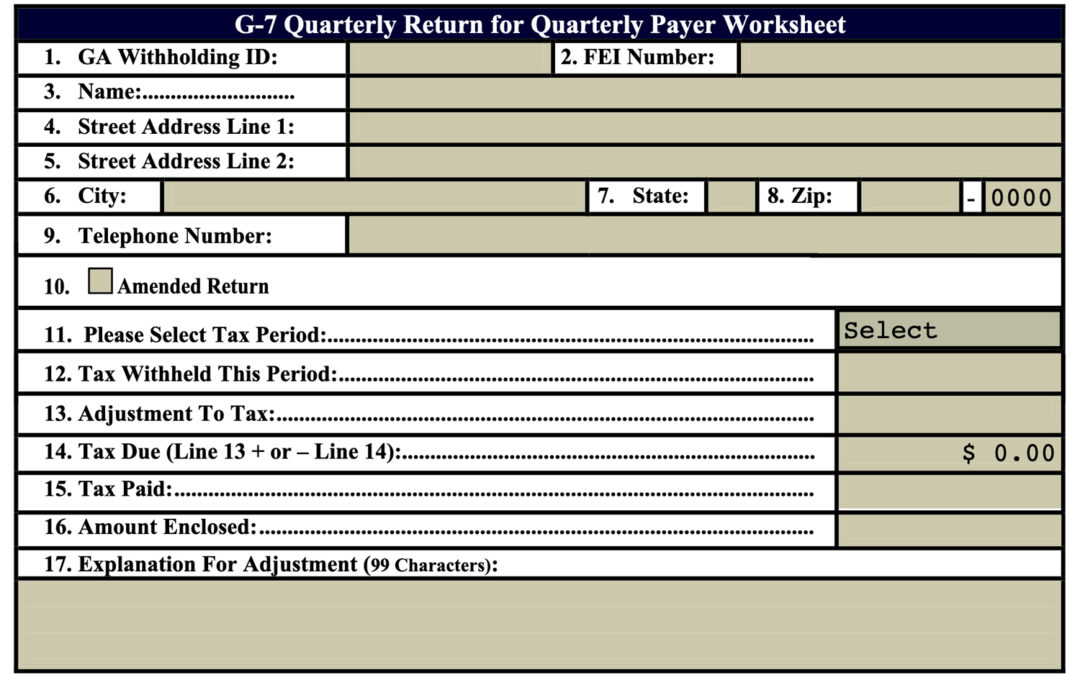

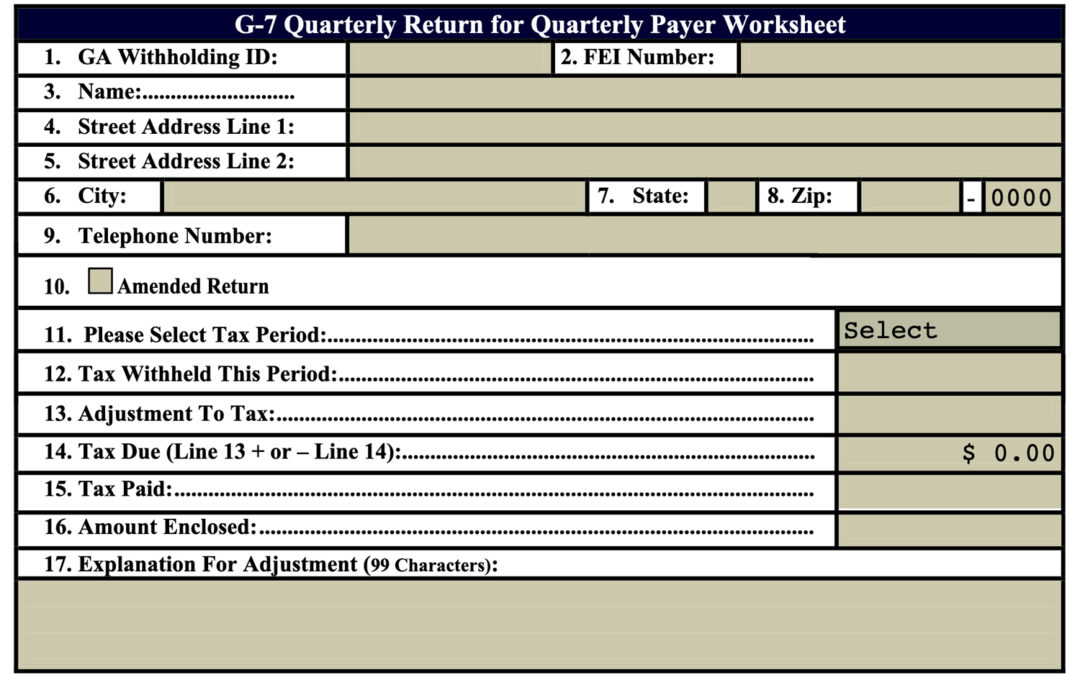

I your small business has employees, you need to withhold and pay Georgia AND Federal income tax on a regular basis. There are five possible payment schedules for withholding taxes in Georgia: Next-business-day Semi-weekly Monthly Quarterly Annually Your payment...

by Jonathan Bill | Aug 9, 2019 | Biz Taxes, IRS, Small Business

Don't forget! If you filed an extension, Corporate & Partnership returns are due 9/15 and Individual returns are due 10/15. Click here to email us today! In the battle against identity theft, the IRS is now permitting employers to use truncated (shortened)...

by Jonathan Bill | Jun 27, 2019 | General Info, IRS, Personal

People tend to underestimate how much they are going to need for retirement. Americans aged 65-74, for example, currently spend an average of $55,000 a year. But 60% of Baby Boomers who haven’t yet retired believe they will need less than that to live on during...

by Jonathan Bill | May 30, 2019 | IRS, Small Business, Tax Season

Our tax system is a “pay-as-you-go” process, which is all pretty straightforward when you receive a regular paycheck, and money is withheld on your behalf. But when you are self-employed — or earn certain other types of income — making estimated tax payments is your...

by Jonathan Bill | May 27, 2019 | IRS, Tax Season

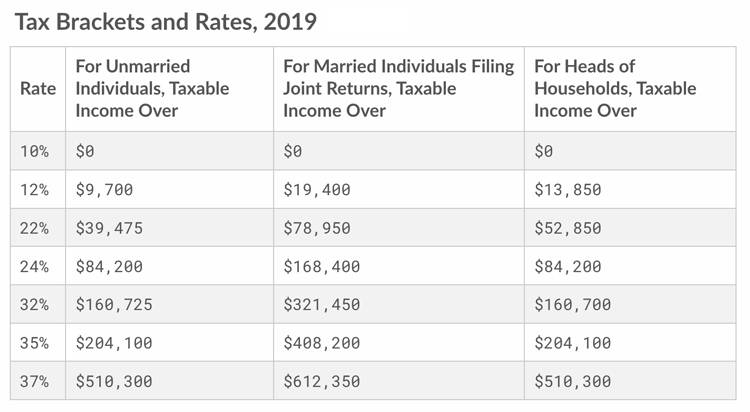

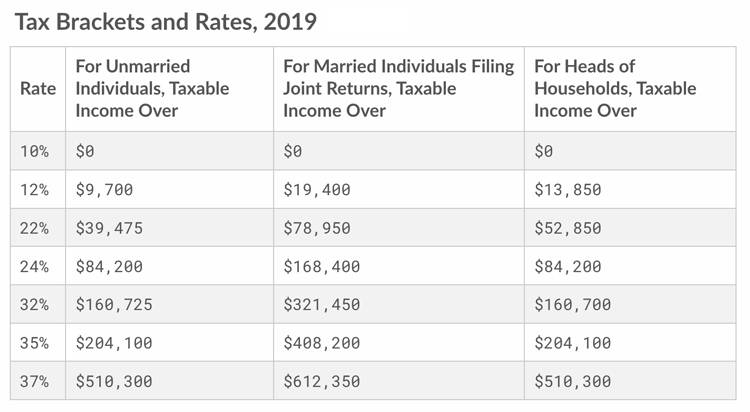

Sounds pretty scary, doesn’t it? Well it is. Each year, the IRS makes adjustments for inflation to more than 40 different tax provisions. The idea is to prevent what is known as “bracket creep.” Without these annual adjustments, you could find yourself creeping into a...