Answers to Your Tax Questions Amid the COVID-19 Crisis

You have questions? We have answers … well, mostly we do! With all the changes to the current tax season, the IRS and the State of Georgia are constantly updating details and requirements. To help condense some of this information, we’ve answered some of the more relevant questions below.

Tax Deadlines & Coronavirus Updates You Need to Know

During a recent Oval Office address, President Trump said the IRS would extend the April 15, 2020, federal income tax filing deadline. However, as of now, the IRS has not yet announced a new date, and it’s not yet clear if the new deadline would apply to all taxpayers. Or how Georgia filing would be affected. So, we are still proceeding as usual with these important dates.

Important Changes to Your 2019 Taxes & Tax Forms

Several years later, the 2017 Tax Cut & Jobs Act continues to impact our taxes and the tax return forms we use. Keep these changes in mind when filing this year.

Georgia Ranks as the #9 Lowest-Cost State to Retire

According to a recent study by GOBankingRates, Georgia ranks as one of the best states to retire if you’re trying to stretch your nest egg. Let’s see where you’re at.

Are You at Risk for an IRS Audit?

Chances are, you will never face an IRS audit — only 0.45% of taxpayers were audited last year. However, you may encounter other types of more-frequent IRS inquiries, such as income-reporting discrepancies or additional tax due notices.

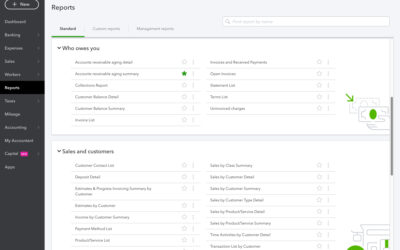

QuickBooks Tip #2: Pull Reports for Quick Info

Need to know just how many invoices are unpaid or more than 30 days past due? Did you remember to bill all of the time and expenses for that project you just completed? With QuickBooks, you can easily find out the information you need.

New Tax Changes May Affect Your Retirement Savings

President Trump signed into law in December a bill to keep the federal government funded. As part of that bill, several new tax changes were enacted, the most relevant of which include changes to some retirement plan rules. The new “SECURE” act is designed to encourage retirement savings and to simplify administrative requirements for small businesses.

Year-End Checklist for Your Personal Finances

With just a few weeks left, take a look at this checklist to make sure your finances are ready for the new year:

8 Year-end Tax Tips for Small Businesses

With December 31 only a few weeks away, now is your last opportunity to make some smart moves to benefit your April tax bill. Keep in mind that your tax rate for 2019 and 2020 will essentially be the same (with modest adjustments for inflation) under the Tax Cuts and Jobs Act (TCJA).