2020 Tax Season Updates Announced

Over the last couple weeks, the IRS has announced a few updates that will apply to the 2020 tax-filing season (for returns processed in 2021). Keep these changes in mind while planning your finances.

A Matter of Choice: Understanding Georgia’s QEE Tax Credit

If you are passionate about school choice, you’ll want to know about Georgia’s Qualified Education Expense (QEE) Tax Credit. Launched in 2008, the program allows individuals, married couples and businesses to claim a dollar-for-dollar tax credit on their Georgia income taxes for donations to qualified preK – 12 schools.

QuickBooks Tip #1: Customize Your Settings

As the most popular accounting software around, QuickBooks is designed to be used by almost any type of business. Whether you’re just getting started or have been using QuickBooks for years, take a little time to set (or update) your company’s settings.

Tax Planning vs. Tax Prep — There Is a Difference

Tax planning is not the same as tax preparation. Tax prep is the process of preparing and filing your tax return each year. Tax planning, on the other hand, is a year-round process designed to help you make smart, tax-advantaged decisions that impact your personal and business finances.

Buy or Lease: What’s Best for Your Business Equipment?

Every business is different, but every business faces the decision on whether to buy or lease equipment. Whether it’s a new computer system for your office or a new truck for your construction business, there are plenty of considerations.

What Else Can We Do for You?

Many of you meet with us at tax time, when you’re closing out your year — or trying to figure out why your tax bill suddenly went up! But there are plenty of other times throughout the year that we can help — and maybe save you some money!

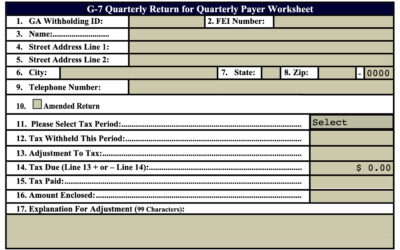

Know Your Payroll Tax Due Dates

If your small business has employees, you need to withhold and pay Georgia AND Federal income tax on a regular basis. There are five possible payment schedules for withholding taxes in Georgia: Next-business-day, Semi-weekly, Monthly, Quarterly and Annually.

How Do the Fed Rate Cuts Effect You?

In July, the Federal Reserve lowered the federal funds rate. Typically, such a rate cut is a preventive measure designed to keep the economy on track. Lower rates put more money into the economy, encouraging businesses to invest and consumers to spend and borrow. While lower interest rates do help, they don’t help everyone.

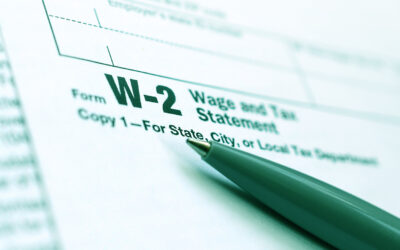

Identity Theft—The IRS Has Your Back

In the battle against identity theft, the IRS is now permitting employers to use truncated (shortened) taxpayer identification numbers (TTINs) on W-2 Forms that are given to employees.